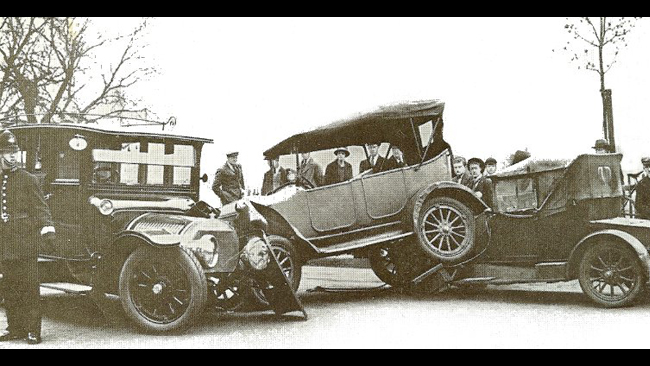

Most people have a story about when they were involved in an accident or a time when their car was stolen, but whether you were insured or not is another story. This week we speak to RateCity’s CEO, Damian Smith, about his American pride and joy and why it pays to have car insurance.What type of car do you own?I own a 1965 Ford Thunderbird and a 1999 Volkswagen Golf. The Golf is my everyday car, the Thunderbird is for weekends.Do you have comprehensive car insurance?Yes, both cars are fully covered which gives me peace of mind. The Thunderbird is always garaged and never parked on the street whereas the Golf is parked on the street continually. Parts for the Thunderbird are rare and expensive so I have to be insured.I use Shannons for my vintage Thunderbird because they are specialists in their field and they don’t haggle around valuations. Shannons are major players in such a specialised market that not many insurers are in.Have you ever been in strife with your car?A while ago I borrowed my partner’s mother’s car while she was overseas and it was stolen. The police later recovered it. Mechanically it was fine but the body was in bad condition and needed a lot of work.Were you insured?Yes we both were. My house was broken into, [which is] where they found the keys for the car which was parked out the front. Insurance covered it though, and took a lot of the stress out of the equation. And let me tell you: getting your mother-in-law’s car stolen is pretty much the textbook definition of stressful!Do you have any advice for fellow drivers out there?Unless you have a car that is literally worth less than $1000, there is no excuse not to have comprehensive insurance. Remember, third-party personal [insurance] is compulsory. And of course, even with the cheapest cars, third-party property protection is an absolute must-have.Despite the fact that we all think we’re better drivers than average, you have to assume that in your lifetime as a driver, the chances of being involved in an accident or theft are high. If your car is worth more than $1000 I just can’t think of any good argument not to compare comprehensive car insurance.What are your three main factors you consider when choosing car insurance?>Price: There is a lot of competition out there when it comes to car insurance, so comparing online at sites like RateCity.com.au or iSelect will help you find a low price to suit.>Claims experience: Ask the insurers about their claims experience. It might be an idea to also look at car insurance blogs and Choice.com.au for reviews.>Exclusions: The fine print matters with insurance. Make sure you always look at the fine print specifically for exclusions to find out exactly what you are covered for and what you aren’t.

Looking for a car loan?

Find best interest rates and no ongoing fees at RateCity.