Industry body reports that growth in novated leases, particularly for EVs, is helping to boost Australian new car sales

Battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) comprised 14.4 per cent of passenger and SUV vehicle sales (excluding light and heavy commercial vehicles) in February, in a month where total sales were up 20.9 per cent compared to February 2023. BEVs and EVs took 9.9 per cent of the market in February 2023.

PHEVs sales are up 126 per cent in January and February 2024 compared with the same period last year.

National Automotive Leasing and Salary Packaging Association chief executive Rohan Martin said demand to buy new cars remains robust for a range of reasons, including new discounts for motorists.

“Our members are reporting robust growth in novated lease sales, particularly as a result of the Government’s EV FBT exemption and greater EV model availability,” Martin said.

NALSPA members have recently reported strong ongoing growth in total novated lease sales, with EVs making up 35 to 40 per cent of all new novated leases.

“The FBT discount is making EVs more affordable to purchase which is driving new interest from a range of Australians across the country,” Martin said.

“As many Australians navigate cost-of-living challenges, they’re looking for ways to help them save on their transport related costs – and a way they are achieving this is by turning to novated leasing. With the benefit of salary packaging, they are able to reduce their income tax, potentially helping to save them thousands of dollars.

“Selecting an EV can save motorists even more when factoring in the EV FBT discount and their reduced running costs.”

What is a novated lease and why is it better with an EV?

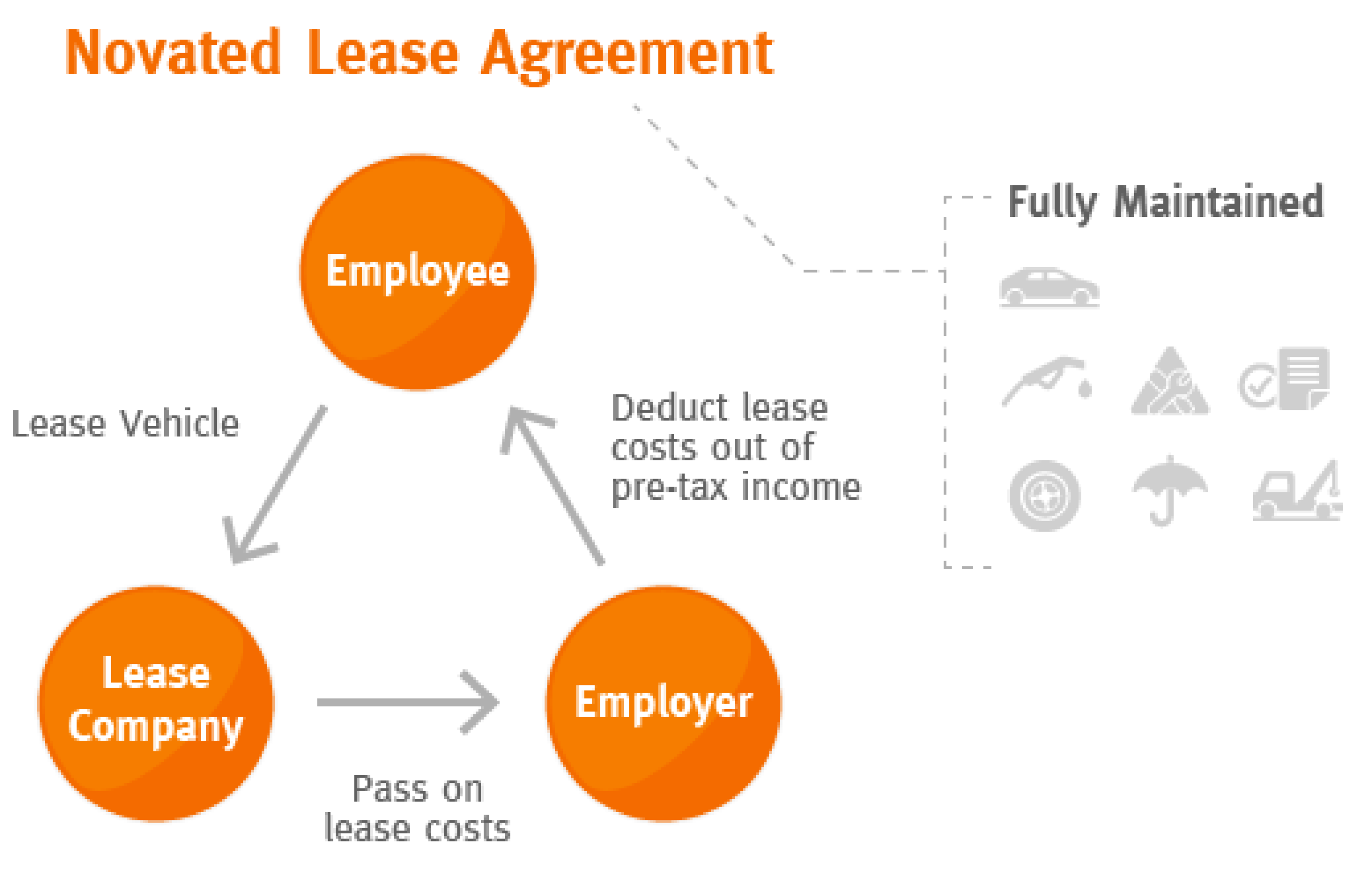

Under a novated lease, you enter into a ‘salary sacrifice’ arrangement with your employer to cover the car lease repayments from your pre-tax salary. You may also include some running costs in your lease.

Your taxable income is therefore lower and you pay less tax: your finance provider or an accountant can help you to work out the potential savings and the other things you’ll need to consider, based on your personal circumstances, before entering into a novated lease.

When you have a conventional combustion car under a novated lease with your employer, the Federal Government considers it to be a fringe benefit. Fringe benefits tax (FBT) may then apply.

Exemption from FBT for BEVs and PHEVs valued below the luxury car tax threshold ($89,332 for FY 2023/24) on novated leases was introduced in 2022, however, reducing the cost of BEV/PHEV novated leases by thousands of dollars per year.

We recommend

-

News

NewsStudy finds novated lease reduces perceived EV price barrier in Australia

More Australians would go electric if under a novated lease to avoid the price premium pain, according to a new study

-

News

NewsWhich banks offer special loans for electric cars?

A growing list of financial institutions are providing lower electric vehicle loan interest rates to help Australians to make the switch

-

Advice

AdviceCar Leasing: What is it and how does it work?

Leasing a new car is becoming increasingly common and is an effective way to get into a car - but it’s not for everyone.