Snapshot

- Fuel excise should go, replace with pay-per-km says FCAI

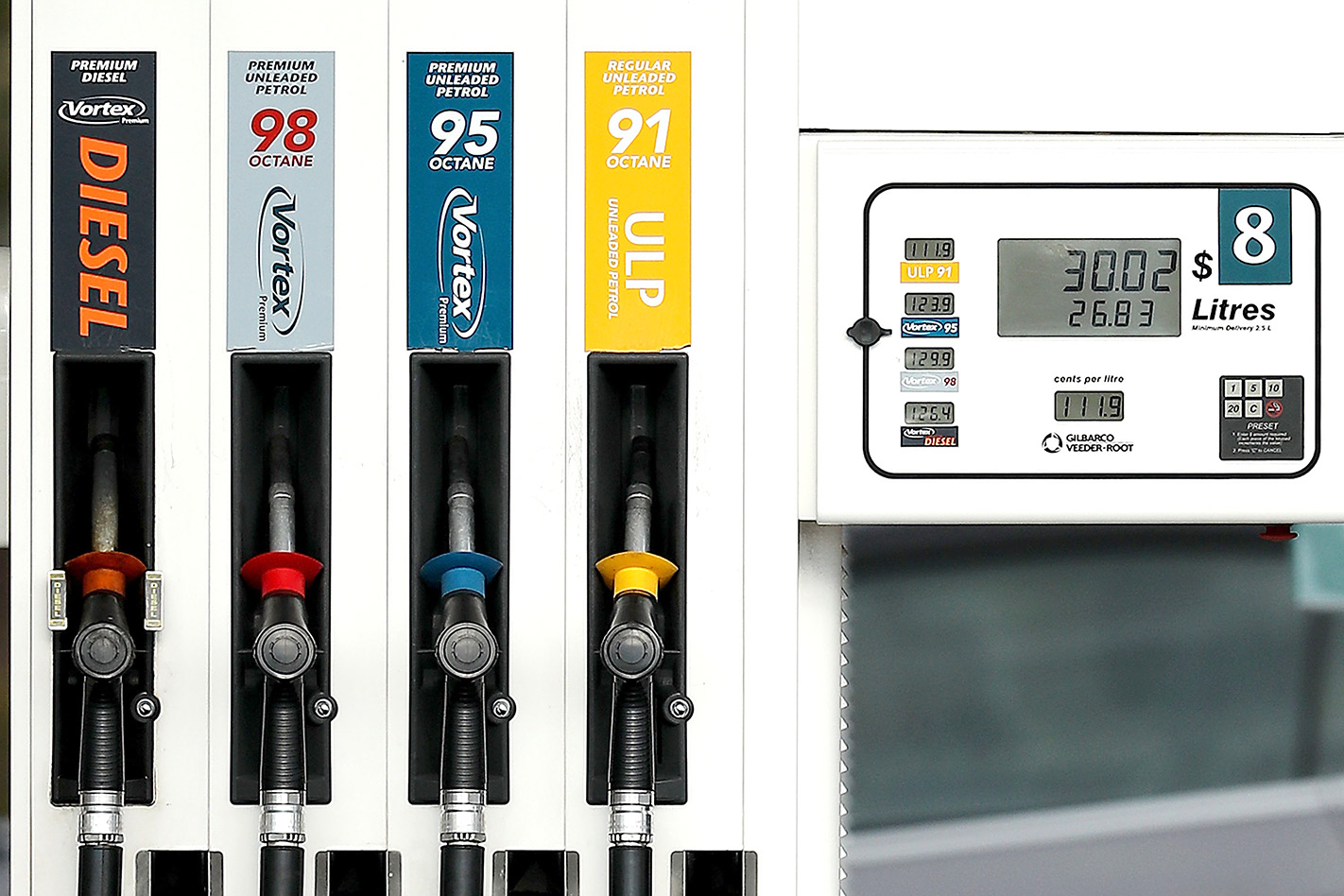

- Prices at bowser hit eight-year high in February

- Federal Election could be catalyst for change

Key industry figures have reignited calls for the fuel excise to be scrapped and replaced with a pay-per-kilometre road-user charging system in the wake of prices rocketing at the bowser.

Automotive industry body the Federal Chamber for Automotive Industries (FCAI) says now is the perfect time for politicians in Australia to be replacing what it calls “ineffective and antiquated taxes on Australian motorists” with a broad-based road-user charge scheme.The FCAI released a paper on the concept in May 2021, with government advisory body Infrastructure Victoria also proposing that other charges, such as registration, be ditched in favour of a pay-what-you-drive system.

FCAI Chief Executive Tony Weber said national tax reform is desperately needed and now is the time to do it.

“State and territory governments are beginning to adapt to the changing nature of mobility in Australia, including the rise of electric vehicles that do not pay fuel excise. Applying this more broadly and scrapping taxes like fuel excise and the luxury car tax will ensure that all motorists are paying an equitable amount to use Australia’s road network,” Weber said.

“Our view is that governments can take this further and apply a road user charge to all vehicles, regardless of their engine type.

“Australians want a future that can provide clarity, simplicity, fairness and value to their wallet. There is no better time than now to bring this future into reality.“Importantly, a road user charge is not an additional tax on motorists. Instead, it can replace myriad charges such as registration, fuel excise licence fees, luxury car tax and sales tax. The reduction in complexity also presents an opportunity to reduce the large bureaucracies required to administer these inefficient taxes and charges, providing additional economic benefit.”

The FCAI chief added that adopting a new system, however, would need to ensure it was fair for everyone, ensuring that those in rural areas weren’t unfairly penalised.

Typically those on lower incomes live further out from capital city CBDs, commuting long distances to work, and therefore suffer either from higher fuel prices or pay-per-kilometre charges.

“The discussion paper released by the FCAI outlines the opportunities and pathways that are available to governments for this type of taxation reform. Clearly the details need to be carefully considered to ensure any scheme considers the application of equity for motorists across the country. This is particularly important when considering rural and regional travel, the Australian lifestyle and our tyranny of distance,” Weber added.

The FCAI’s call comes at the same time as the Australian Competition and Consumer Commission (ACCC) announced that the price of international refined petrol and average retail petrol in Australia’s five largest cities reached an eight-year high in February.

Russia’s invasion of Ukraine and the OPEC cartel’s refusal to boost crude oil production, combined with recovering oil demand as countries relaxed COVID-19 restrictions, pushed February prices to record levels.

The ACCC’s latest petrol monitoring report reveals that daily average retail petrol prices in Sydney, Melbourne, Brisbane, Adelaide and Perth hit 182.4 cents per litre (cpl) in late-February, which was the highest inflation-adjusted level since 2014 – and continued to rise throughout the first two weeks of March.

The report looks at the final quarter of 2021, but also provides additional data and analysis up to the end of February.

“Crude oil prices have been climbing sharply since late-2020 and prices at the bowser here have followed,” ACCC Chairman Rod Sims said.

“The world was already experiencing high crude oil prices late last year due to the continuing actions of the OPEC and Russia cartel, and the enduring Northern Hemisphere energy crisis. The shocking events in Ukraine have forced crude oil prices even higher, as Russia is a major supplier of oil.”

“Retail petrol prices in Australia are largely determined by international refined petrol prices and the Australian/US dollar exchange rate. As refined petrol is made from crude oil, movements in the global crude oil price drive the international price of refined petrol.

The last time prices in Australia were as high as they were in late-February was in January 2014, when strong international demand, conflicts in the Middle East and Ukraine, and a lower AUD/USD exchange rate pushed real daily average petrol prices to 182.7 cpl.

In June 2008, in the period before the Global Financial Crisis, daily average prices reached a record high equivalent to 212.9 cpl in today’s money.

We recommend

-

Industry

IndustryRoad use charges should replace fuel excise, think tank warns

If we want to beat congestion in the future, the way the government earns revenue from drivers will need to change, Infrastructure Australia says

-

News

NewsTrack and charge: FCAI releases plan to overhaul road user costs

Registration and other key forms of taxation would be scrapped, according to the FCAI, in favour of tracking vehicles and charging for road use

-

News

News"Replacing tobacco excise with nicotine patch tax" - EV tax explained

A Victorian Government fact sheet spells out how the contentious EV tax will be charged and when and how it will need to be paid