The price of lithium – a key ingredient of electric vehicle batteries – has surged in recent months, and could force the price of electric cars higher.

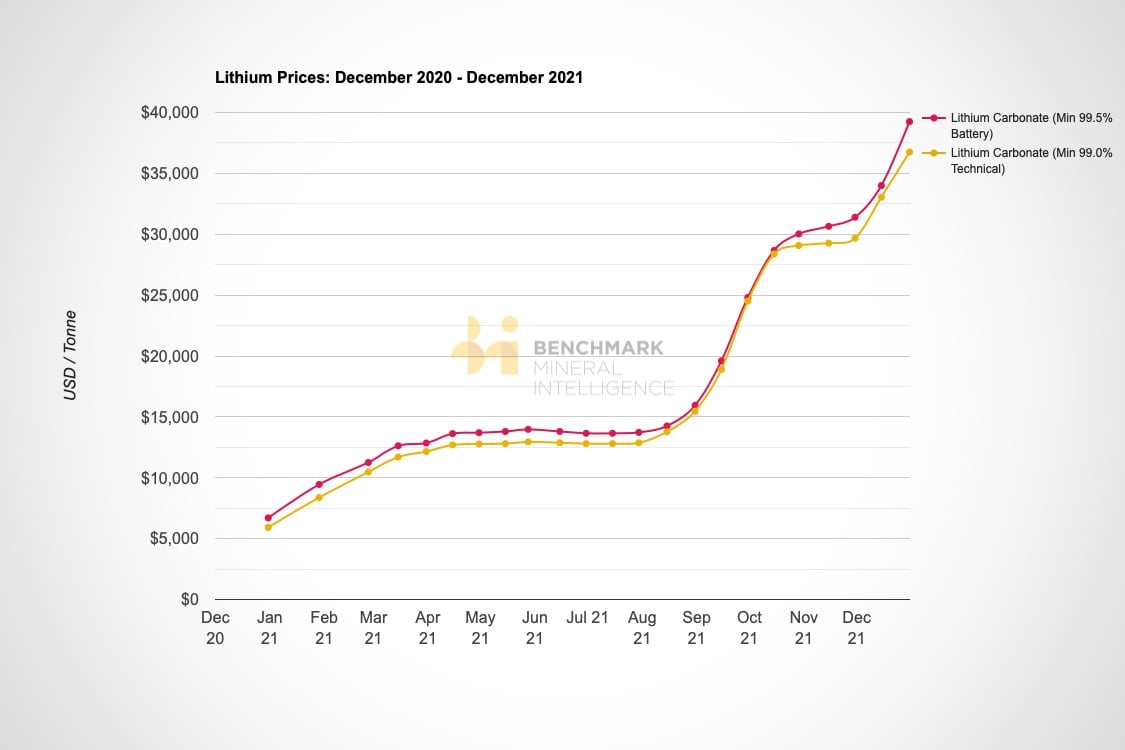

Over the past year, Chinese lithium carbonate prices have increased by more than 485 per cent, according to commodities analytics firm Benchmark Mineral Intelligence (BMI).

The metal has set a new record by breaking through US$40,000 per tonne, which BMI says is driven by “strong demand from the electric vehicle battery sector throughout 2021, compounded by seasonal restocking of lithium carbonate inventories ahead of Spring Festival 2022 in China”.

It’s not just lithium that has seen gains in 2021, with the Bloomberg Commodities Index increasing by more than 25 per cent over the past 12 months. While it’s good news for Australian lithium miners, it’s electric car buyers that could get stuck with the bill.

Unless there’s a significant pullback in the price of lithium, it’s likely the increased costs will trickle down to the showroom floor.

In recent days, Joe Zidle from global investment firm Blackstone named lithium as part of his annual list of surprises for the coming year.

“In a setback to its green energy program, the United States finds it cannot buy enough lithium batteries to power the electric vehicles planned for production,” Zidle wrote in his New Year predictions.

“China controls the lithium market, as well as the markets for the cobalt and nickel used in making the transmission rods, and it opts to reserve most of the supply of these commodities for domestic use.”

We recommend

-

News

NewsVolkswagen signs five-year deal with Australian lithium mining company

Volkswagen partners with specialist battery companies to help it achieve an EV production capacity of over two million cars per year

-

News

NewsMonash University achieves electric vehicle battery milestone with sugar hit

Adding a little sugar to lithium-sulfur batteries makes them far more durable, while maintaining their superior energy density

-

News

NewsGeneral Motors to secure enviro-friendly and low-cost American lithium for its BEVs

Low carbon emissions ‘closed loop’ production set to power GMs next-gen vehicles