The general manager of Mitsubishi’s electrified powertrain engineering division, Takashi Shirakawa, acknowledged that battery electric vehicles (BEVs) are the future for both Mitsubishi and the auto industry as a whole.

In the brand’s mid-term plan (up to the end of 2025) there are no plug-in hybrids slated for release – but that doesn’t mean Mitsubishi has lost interest in PHEVs.

“We are trying to stand up in the niche market until 2050 with PHEV because some customers need PHEV, and most OEMs do not make PHEV a priority”, Shirakawa-san told Wheels.

If we continuously improve PHEVs, our product may attract some customers because PHEVs compensate for the lack of performance from battery EVs.

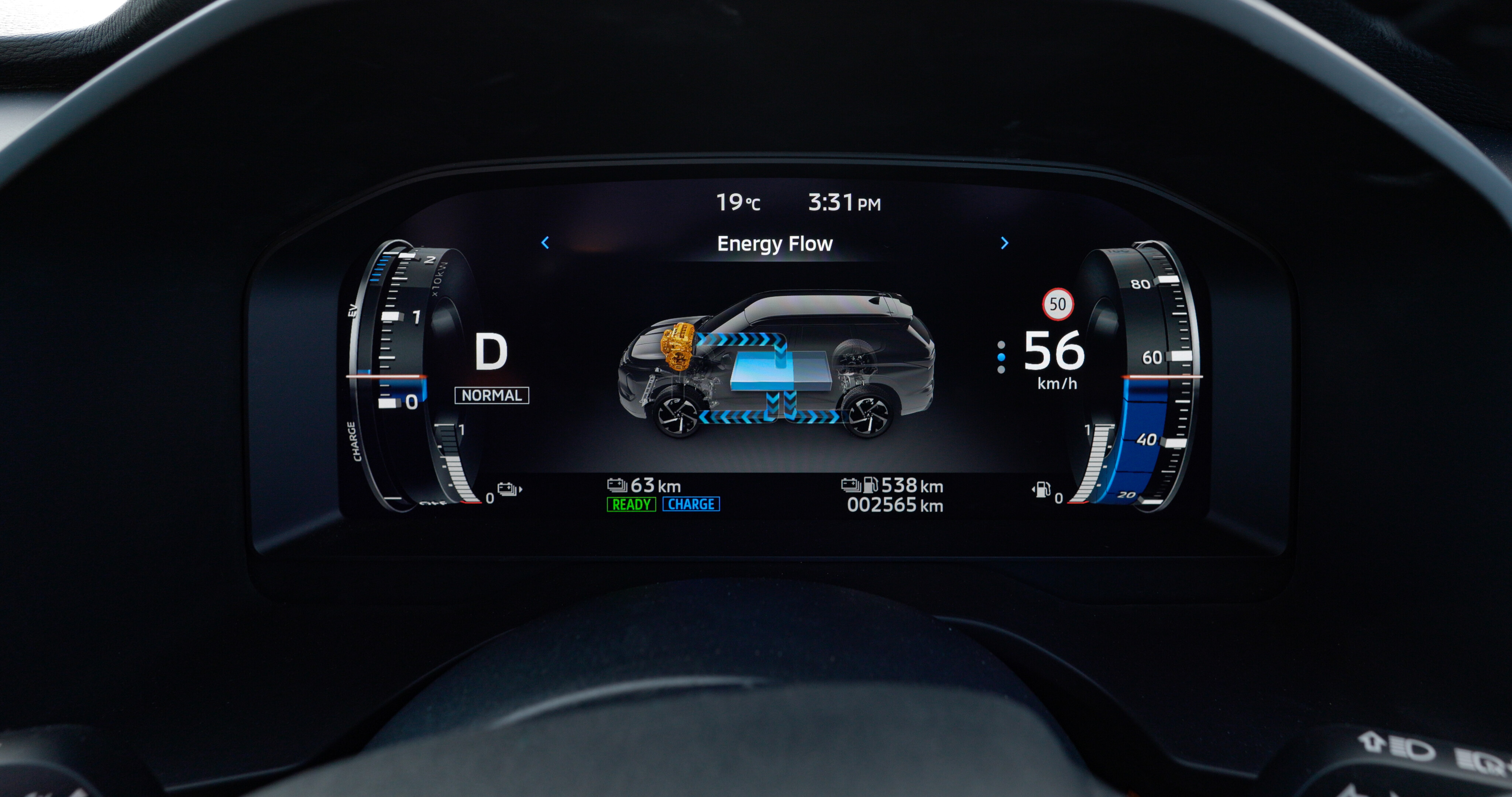

It’s simple, if there’s demand and you’re the only company investing in innovative solutions (like the Outlander’s plug-in powertrain, that features a single-speed front transaxle and independent rear motor, which is very different from Volkswagen and BMW’s attempts), then you’ll reap the rewards.

“If we continuously improve PHEVs, our product may attract some customers because PHEVs compensate for the lack of performance from battery EVs. Of course, BEV is an excellent solution, but it's quite a unique product. So that is our current strategy”, Shirakawa-san added.

As the Alliance leader on PHEV tech, Mitsubishi’s solution also reflects its intended growth regions – ASEAN and Oceania – where grid energy is produced with a higher CO2 footprint (Mitsubishi’s data centres on 600g/kWh in ASEAN, 300g/kWh in Oceania, and the EU roughly 150g/kWh) meaning the impact of BEVs is less significant, or even worse, than an efficient combustion vehicle.

This equation isn’t quite so clear-cut in Australia (especially if you have solar panels installed and charge at home), but the brand believes that plug-in hybrids are still the cleanest solution for a slice of the population.

The other concern in Mitsubishi’s growth regions is cost. It’s why vehicles that are cheap to build, such as body-on-frame SUVs and utes, are popular, and Mitsubishi thinks the cost of a BEV that is able to satisfy the needs of customers may be prohibitively expensive.

Shirakawa-san points out that it isn’t the functionality of the BEVs in question here, but rather the high cost of materials such as Nickel and Cobalt, that will give smaller-batteried plug-in and traditional hybrid technology a leg-up in some markets.

COMMENTS