You won’t find any official UN report card on EV manufacturing – although the council’s trade body has previously sounded the alarm on the mining boom [↗] – but now there’s this: Lead the Charge, a self-appointed watchdog for the car industry.

Launched in March 2023, Lead the Charge is built around the idea of an industry scorecard, tracking and ranking the efforts of leading carmakers to ensure every part of their EV supply chain is “equitable, sustainable, and 100% fossil free”.

“The Leaderboard analyses publicly available reporting from 18 of the leading automotive manufacturers in the world,” Lead the Charge says. “It ranks their efforts to eliminate emissions, environmental harms, and human rights violations from their supply chains.

The billboard shown above is part of a campaign against lithium mining. While salt mining is not a problem, people from Argentina's Jujuy Province are against the extraction of Lithium in Salinas Grandes area. They claim this industry will destroy their natural water reservoirs. Photo: Getty Images | Luis Andrew Sampaio

How does Lead the Charge assess each brand?

Lead the Charge says its methodology is built on publicly available reporting from the brands themselves (as required by governments and various boards), focusing on aspects of sustainability and human rights within supply chains.

Although the organisation offers a full list of indicators and score attributions, the accuracy of its methodology might vary across different brands depending on their supply chain transparency.

The process has also had significant updates and amendments for 2024, including changes in definitions and improved precision – it says – in measuring “pre- and post-consumer scrap” and battery recycling.

2024 results

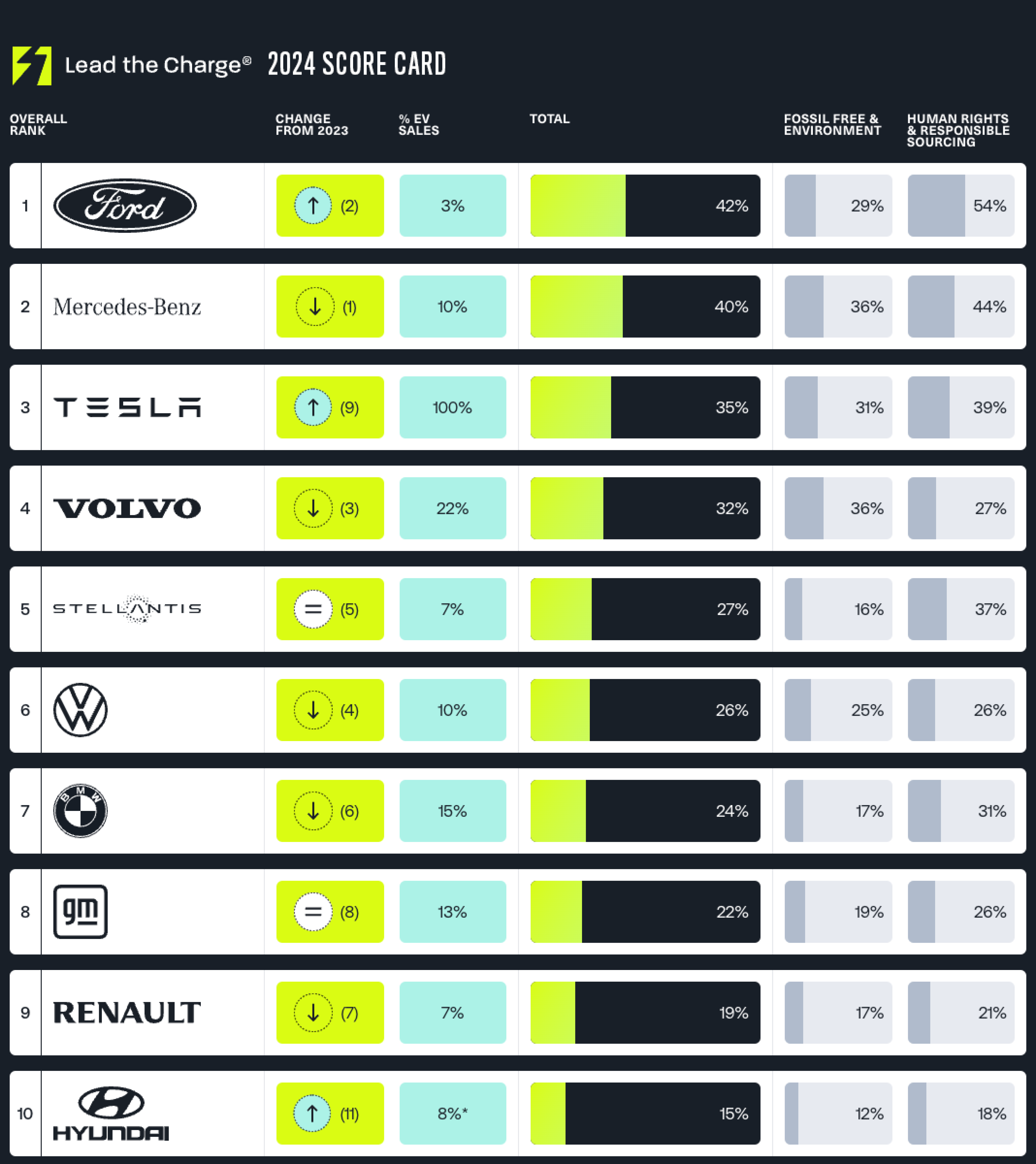

The full list of 18 brands can be found on the Lead the Charge website. We’ve listed the top 10 below.

This year’s report says that while all brands have failed on indigenous peoples’ rights (with 11 of the 18 tracked brands achieving a score of 0% on that metric), there has been marked progress in reducing supply chain emissions.

None have impressed the organisation, however.

Ford’s new position atop the chart comes off a score of 42%, thanks to improvements in the mining, production and transport of its steel and aluminium – meaning that even the best performing brands are well behind on the report’s criteria.

The organisation says Tesla’s leap from ninth to third is thanks to the American carmaker “becoming the first automaker to disclose disaggregated scope 3 emissions for its steel, aluminium, and battery supply chains”.

Indigenous rights remains the burning issue for all brands, however.

“One of the dismal findings in the report was an almost industry-wide inaction on ensuring a just and equitable transition across automotive supply chains. Average scores on the responsible sourcing of transition minerals, Indigenous Peoples’ rights, and workers’ rights have risen by only 2%,” the report says.

Ford Leads: Ford tops the Leaderboard with a 42% score, surpassing Mercedes and showcasing leadership in workers' rights and supply chain cleanliness.

Tesla's Leap: Tesla jumps to third place with the largest score increase, highlighting its progress in disclosing scope 3 emissions and improving in responsible sourcing and Indigenous Peoples' rights.

Human Rights Gaps: Despite some progress, there's a significant lack of advancement in Indigenous rights, with all major automakers, including Ford and Mercedes, showing no improvement.

Global Influence of EU Regulations: EU regulations positively impact automakers worldwide, driving improvements in human rights due diligence and environmental practices.

Supply Chain Emissions Focus: The report emphasises the urgent need for automakers to address supply chain emissions to meet their climate goals.

Lagging Behind: Toyota and other automakers are criticised for not sufficiently cleaning up their supply chains, risking their competitive edge.

Indigenous Peoples' Rights Inaction: The industry shows almost no progress on Indigenous Peoples' rights, with 11 out of 18 automakers scoring 0% in this area.

Steel Decarbonisation: Over two-thirds of automakers are moving towards green steel, marking a significant shift from the previous year, with East Asian automakers falling behind.

Transition Minerals and Decarbonisation: Ford excels in transition mineral sourcing and decarbonisation of steel and aluminium, yet the overall industry progress is slow.

Increased Regulation and Compliance: 2023 saw improvements in supply chain practices due to EU legislation, with some Chinese automakers making notable strides in human rights and environmental practices.

COMMENTS