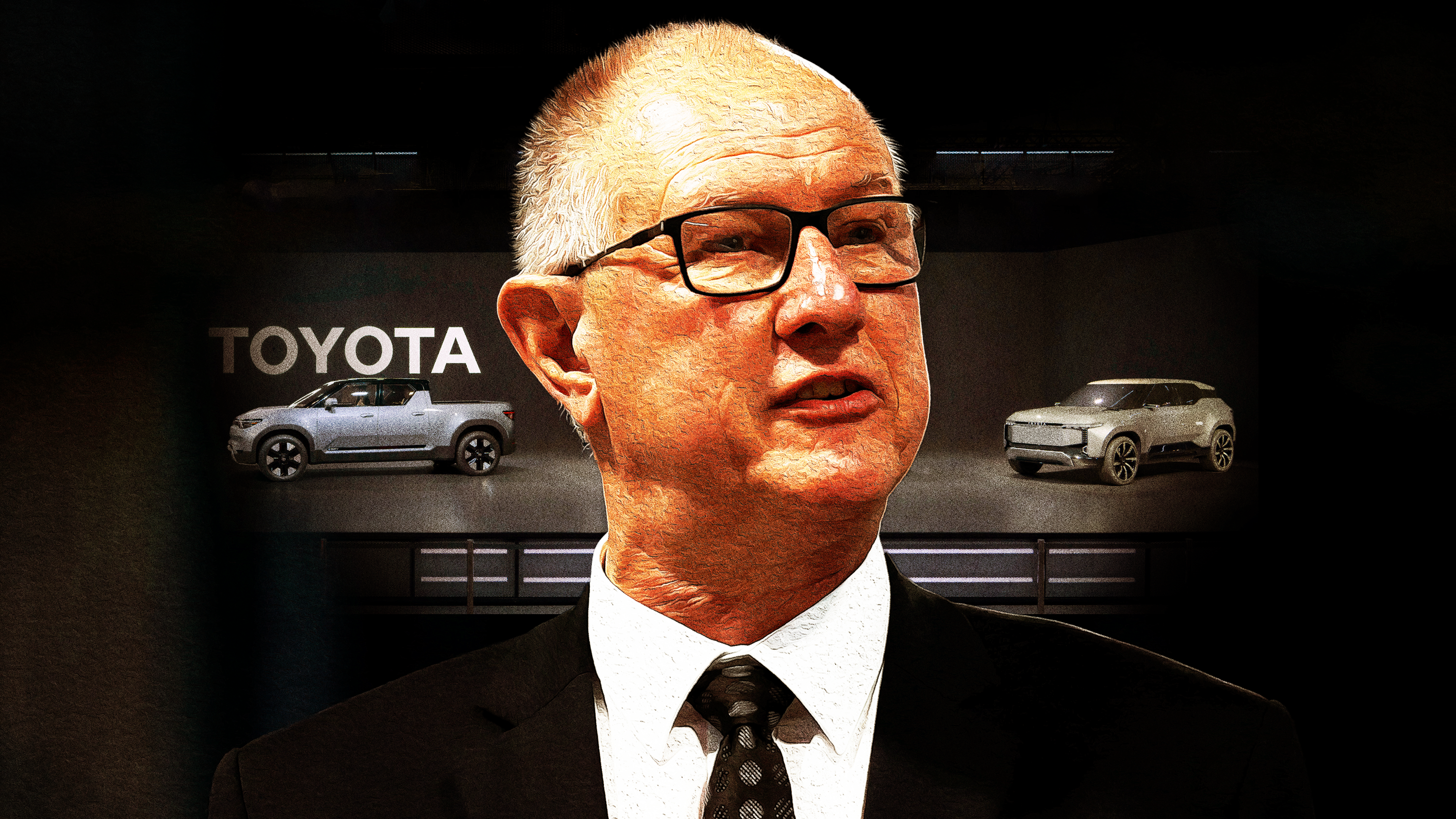

He’ll tell you he loves the chat, and he truly does love a laugh – but you can see that Sean Hanley, Toyota Australia’s long-serving sales boss and voice of the business, is growing tired of the unrelenting questions around the company’s future as it applies to electrification.

After all, as the major pioneer of petrol-electric hybrid technology and unquestionably the world’s leader in that category, you might think the company would be blazing the trail for what comes after hybrids.

It’s not that easy, Hanley insists, and really he’s right – for a few reasons. The one he’s constantly beating the drum for, perhaps terminally, is Toyota’s commitment to leaving no buyers behind.

That’s a major profit imperative, obviously, but no executive would ever be quite that transparent outside of a shareholders call. And, really, the two ideas are entwined: giving customers what they need and want and know is the key to consistent profit. (Economics 101, done.)

There’s another concept here, though: the innovator’s dilemma [↗].

Defined in 1997 by Harvard professor and businessman Clayton Christensen, this dilemma describes successful companies focusing resources on activities that address customer needs while reaping the highest profits – which usually means continuing with a proven and long paid-for model, evolving slowly rather than suddenly sinking billions into an interesting but uncertain new technology. Shareholders just hate that.

That’s where disruptors like Tesla get their foot in the door, and while other traditional leaders in the automotive market have pivoted as quickly as feasible to catch up, Toyota spent years insisting that EVs wouldn’t suit the market for a long time to come – until it very recently conceded that, actually, it would now pour its considerable resources into catching up with critical improvements to its EV technology suite. It probably will get there, too, but in the meantime it all looks a bit embarrassing.

For now, the company has just one EV confirmed for Australia, the nearly three-year-old BZ4x (recently updated), and it’s already overdue – by its own schedule and absolutely in comparison to a number of other volume brands here.

Indeed, with Nissan, Mitsubishi, Mazda and Subaru also lagging, it’s more of a Japanese issue than a Toyota problem alone – but Hanley is usually the only local leader open to (or allowed to engage in) a relatively frank conversation on the topic.

Hanley’s right to insist, though, that a great many aussies aren’t ready for EVs. And while those who are can choose from a fairly broad range of options (so long as what you want is a small EV from around $40k or anything bigger from around $65k), Toyota will continue to serve those who either need or can only afford a petrol, diesel, or petrol-electric vehicle.

That’s a lot of Toyota’s buyers. Whether it’s off-roading or load-hauling, Toyota’s offerings in those segments can’t simply be swapped out for EVs overnight. The people who want and need them, need them to come with as few compromises and routine-upending changes as possible.

“And that’s why just simply saying moving to BEV as a single solution to everything can’t work in Australia. It’s not right,” Hanley told Wheels this week on a year-end VFACTS sales call.

“Have a look at the top selling three Australian vehicles in the market in 2023. Well hello, [BEV] is not one of them. They’re all utes… they’re all diesels. Well, not all diesels, but mostly diesels.

“It’s very clear Australians need to have vehicles to do the things they want them to do.”

You can get an electric ute in Australia, but the only OEM-made option – the LDV eT60 – is expensive and nobody’s idea of a good thing.

Toyota has its HiLux Revo here now, but it’s not available to you and me. There’s also a handful of conversion businesses, but they’re largely for fleets who’ve committed to a certain level of greenification regardless of the cost.

And you certainly won’t find an electric off-roading SUV in any Australian showrooms. Even America doesn’t have many, apart from the massive (and massively expensive) Hummer EV, the hard-to-get Rivian R1S and the Cyberstuck – sorry, the Cybertruck. The F-150 Lightning is hugely popular, but Ford has also never marketed it as an off-roader. Many owners have also discovered it’s not ideal for towing [↗].

So it’s no surprise that Toyota Australia doesn’t see itself easing up on petrol, diesel and hybrid offerings anytime soon, regardless of how far behind it may or may not be (it is very far behind) in the EV space.

“One of the things we are committed to trying to do is developing models that are capable of doing the things that the market we sell into expect,” Hanley said.

“So when you look at a LandCruiser, people expect that to be able to go off road. People expect to be able to get long range. People expect to be able to tow tonnes of weight and caravans. That’s what Australian consumers want.”

“It’s incumbent on us as a manufacturer Toyota to bring those vehicles to market that can do those things, but reduce our carbon footprint dramatically between now and 2030,” Hanley added. “Therefore, we need to look at a suite of technologies to do that to allow Australians to still have cars they richly desire.”

“When you look at hybrid, we’ve been doing hybrid since October 2001. It’s taken every bit up to December 31, 2023, to sell over 380,000 vehicles. There’s an education piece and an adjustment piece required for the market.”

Critically, Hanley’s argument overlooks the fact that for most of its run as Australia’s pre-eminent peddler of hybrids, its options were limited to the not always appealing Prius hatch. The very successful hybrid Camry series (over 80,000 sales so far, dominating in fleets) launched around six years after the first Prius (20,778 sales), followed much later by the Prius V people-mover in 2012 (4599) and the Prius C hatch (9420).

The Corolla Hybrid launched in 2016 and the brand’s petrol-electric offerings have only grown since then. Indeed, the Camry will be exclusively hybrid in its newly updated form.

That’s it, really. Even if Toyota had a range of EVs available today, it probably wouldn’t sell a great many fewer combustion models, because so many of its buyers are the risk-averse type.

That’s why they go for Toyota, right? Reliable, proven, predictable. EVs? Too many question marks for the average Toyota buyer. (I’m generalising, I know, but satirically. Mostly.)

Still, I can’t help but wonder at the difference it would make to buyer confidence, market competition and infrastructure commitment if Toyota was already campaigning with a strong range of advanced, segment-leading EVs.

On the other hand, Kia and Hyundai are probably glad and emboldened to know they’ve already stolen a march on their number-one rival – in the sense that Korea has more than a few historical bones to pick with Japan – and they clearly have at least a few more years on Toyota. Then there’s the buying and subsidising power of the Chinese. Youch.

Why not both?

Why Toyota didn’t commit sooner to hybrid and EV side-by-side, for both buyer types – back when this was all more of a market curiosity than an increasingly set landscape – is an accounting and manufacturing quandary beyond my ken. Perhaps there’s a similar question there for Nokia, Kodak and Blockbuster, or maybe just IBM – still in business and doing fine, but no longer dominating the IT industry. Innovator’s dilemma, indeed.

Hanley would happily take every EV headquarters can offer – and damn that electric LandCruiser SE concept looks good – but for now, he’s got a line to stick to. Luckily for him, he’s pretty good at reminding us that people interested in or curious about EVs aren’t the only people that need a car – and Toyota’s still the biggest-selling brand in Australia. That’s not nothing.