Australia’s 2023 used car sales: Key figures

- 2,074,535 used cars were sold in 2023

- Around 61% of used cars were sold privately

- Petrol (65.8%) and diesel (30.6%) made up the majority of used car sales

Nobody waiting on a new car delivery will be surprised to learn this: the Australian used car market saw a significant level of activity in 2023.

Highlighting strong interest in the used car market, the Australian Automotive Dealer Association (AADA) and its partner AutoGrab have today released the 2023 results of the new Automotive Insights Report (AIR).

Sales figures surpassed the 2 million mark last year, representing a 34.4% increase. By comparison, just over 1.2 million new cars were sold – a record year in the new-car space.

RELATED: New-car sales results for 2023

Sales and market dynamics

Key Points

- Toyota was the top selling used car brand with 16.6% market share, followed by Mazda (8.2%) and Ford (8%).

- The Ford Ranger was the top selling used vehicle with 65,938 units, pipping the Hilux (65,852) by only 86 units

- October & November were hottest, with both months passing 200,000 sales

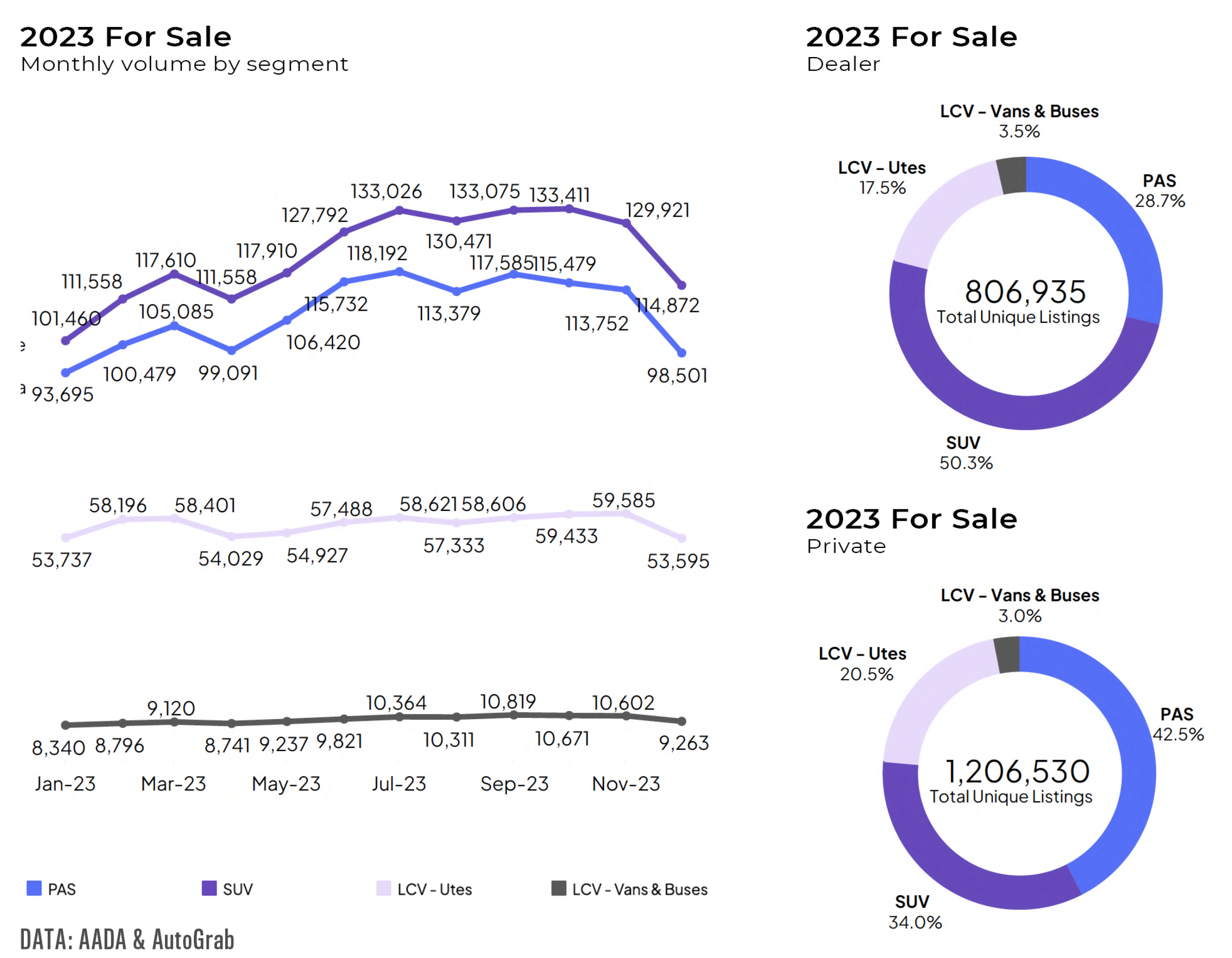

- Passenger cars accounted for 43.9%, SUVs 36.9%, and LCV Utes represented 17.3% of total used car sales.

The report [↗] shows a robust result for 2023, with AADA boss James Voortman pointing to factors like wait times and the increasing cost of living.

“For every new car sold 1.7 used cars were sold, confirming that most Australians are deciding to purchase used cars,” he said.

2023 used car sales by state

| State | 2023 Sales | Market Share |

|---|---|---|

| NSW | 617,392 | 29.8% |

| VIC | 491,441 | 23.7% |

| QLD | 460,140 | 22.2% |

| WA | 262,150 | 12.6% |

| SA | 139,129 | 6.7% |

| TAS | 47,393 | 2.3% |

| ACT | 39,713 | 1.9% |

| NT | 17,177 | 0.8% |

| Total | 2,074,535 | 100.0% |

Used car prices and sales patterns

Used car prices saw a steady decline through 2023, a trend attributed to an increase in the supply of new vehicles – thanks to the reduced impact of Covid on production and shipping.

This shift in pricing is anticipated to continue into 2024, potentially benefiting buyers seeking cost-effective options in a tight economic climate.

The National Weighted Average Used Car Price peaked in March with a Retained Value of 75.8%, before declining to 67% in December. The average number of days to sell rose from almost 41 to to nearly 51, March to December.

Top-Selling brands and models in used cars

Again no surprises here, Toyota was the most purchased used car brand in 2023, although Ford’s Ranger outsold Toyota’s Hilux – just as it did in new cars.

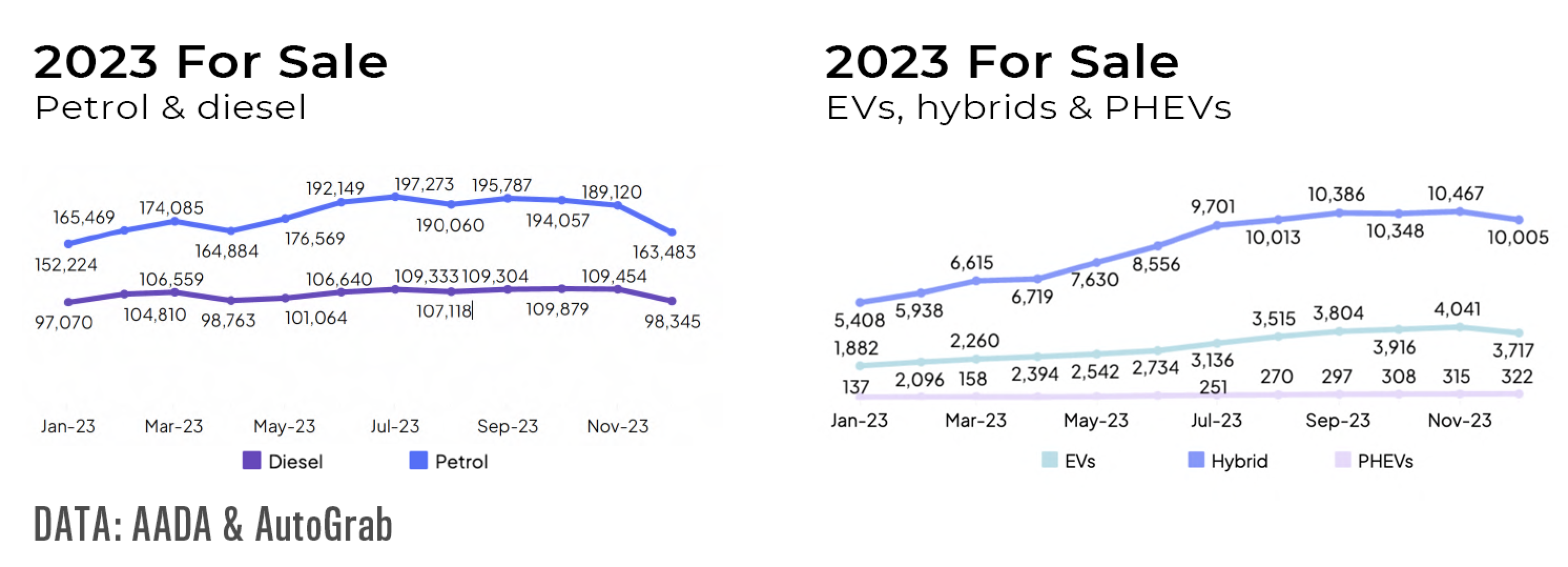

Sales by fuel type

| Fuel Type | 2023 For Sale | Market Share |

|---|---|---|

| Petrol | 1,308,274 | 65.0% |

| Diesel | 625,357 | 31.1% |

| Hybrid | 61,443 | 3.1% |

| EVs | 13,748 | 0.7% |

| LPG | 3,233 | 0.2% |

| PHEVs | 1,410 | 0.1% |

| Total | 2,013,465 | 100.0% |

Top brands

| Brand | 2023 For Sale | Market Share |

|---|---|---|

| Toyota | 328,431 | 16.3% |

| Mazda | 166,024 | 8.2% |

| Ford | 156,823 | 7.8% |

| Hyundai | 153,359 | 7.6% |

| Holden | 138,940 | 6.9% |

| Mitsubishi | 115,226 | 5.7% |

| Nissan | 112,947 | 5.6% |

| Volkswagen | 108,636 | 5.4% |

| Kia | 74,095 | 3.7% |

| Mercedes-Benz | 67,140 | 3.3% |

| 2,013,465 | 100.0% |

Top models

| Model | 2023 For Sale | Market Share |

|---|---|---|

| Ford Ranger | 65,810 | 3.3% |

| Toyota Hilux | 62,086 | 3.1% |

| Toyota Corolla | 49,032 | 2.4% |

| Mazda 3 | 44,238 | 2.2% |

| Hyundai I30 | 43,158 | 2.1% |

| Toyota Camry | 38,892 | 1.9% |

| Holden Commodore | 36,825 | 1.8% |

| Mitsubishi Triton | 36,387 | 1.8% |

| Nissan Navara | 35,121 | 1.7% |

| Toyota Landcruiser | 31,786 | 1.6% |

| 2,013,465 | 100.0% |

Value retention

The report sheds light on the retained value of various vehicle types, with utes and light commercial vehicles generally holding their value better than other categories.

SUVs, in contrast, were reported to have lower retained value, “sitting well below average for all age groups”.

“When diving into retained values of vehicles, a topic that interests many consumers and Dealers, we can see that across all age groups, utes and light commercial vehicles held their values above the average,” Mr Voortman said.

“Passenger vehicles across all age groups tracked close to the average, while SUVs were the worst performing vehicle segments in terms of retained value, sitting well below average for all age groups.”

Electric vehicle market

Electric vehicles (EVs), while still a small segment of the used-car market, showed a small increase in supply and sales.

The AIR notes that EVs have a lower retained value and take longer to sell than petrol and diesel vehicles, hinting at the challenges facing this emerging market segment.

Prices have declined by 15.6% for used EVs under 2 years old, and 23.4% for those aged between 2-4 years. The average days to sell for used EVs reached 75 days in December.

The report suggests hesitation on used EVs is likely due to uncertainty around battery longevity, along with compelling new prices at the entry end of the new EV market.