Jim Chalmers announced the Albanese Government’s 2023-24 federal budget last night and there wasn’t much for motorists – that’ll have to wait until later in the year when the fuel efficiency standards are outlined.

What may affect your buying habits is the softening of the government’s instant asset write-off scheme.

Beginning in 2020 in an effort to combat falling spending habits during Covid, the government allowed businesses with turnovers up to $500 million to instantly write off assets valued up to $150,000 until June 30 2023. This applied to both new and used vehicles – everything from single-cab utes to prime movers.

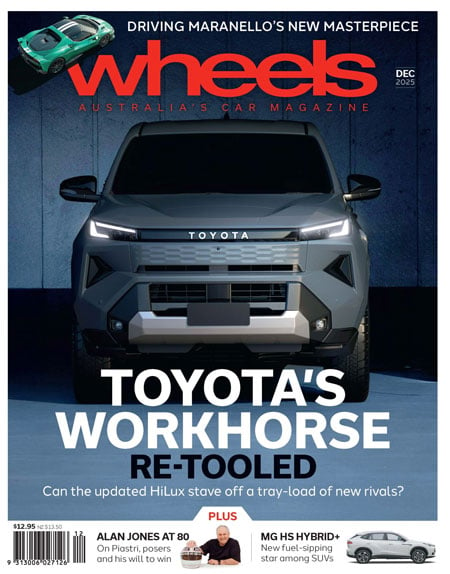

As an example, if you bought a new Toyota HiLux for $50,000 that spent 90 per cent of its time used for business, you’d be eligible to write off $45,000 instantly.

For 2023-24, however, the incentive has been rolled back significantly. Now limited to businesses with a turnover of less than $10 million, the scheme only covers assets up to $20,000.

It’s worth noting that, if you have a work ute on order that isn’t arriving until after June 30, you won’t be eligible for the previous benefits – even if you’ve paid a deposit already.

Dual-cab ute comparison 2022: The daily living test

Dual-cab utes have charged in as a firm favourite for family hauling and daily duties, well beyond the old mould of tradie tasks and off-road adventures. It’s time to see which are best suited to the role.

The government is instead encouraging companies to improve energy efficiency. Businesses with annual turnovers less than $50 million are eligible for a 20 per cent tax deduction for more efficient assets valued up to $100,000.

The maximum bonus deduction is $20,000, and this is intended for efficient cooling and heating systems, battery storage devices, and other electrical goods to make businesses more efficient, though it excludes electric vehicles.