You know how it goes – you’re enjoying your new car, loving life and taking all the happy snaps a new owner does when they bring their toy home.

Suddenly, for whatever reason – fire, hail, a crash – it’s written off. The vehicle you spent your hard-earned on is no longer serviceable and it’s back to the dealers to get a new one.

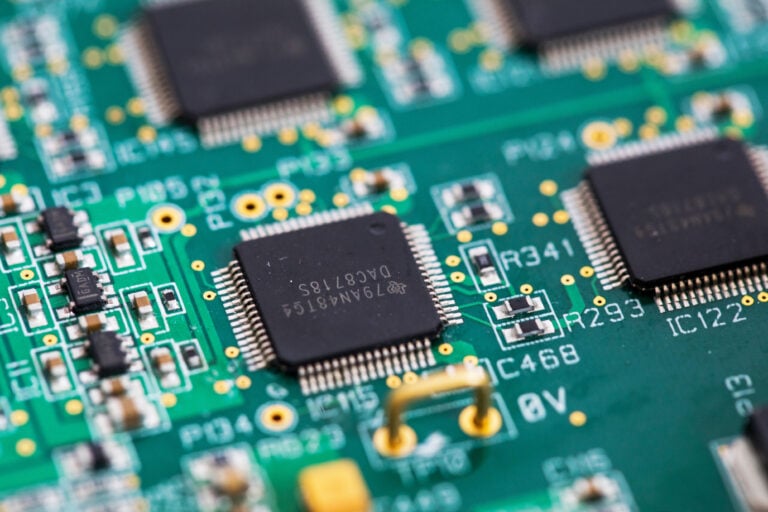

Although some insurers offer a new replacement car for those which are under 24 months old, this is a hard promise to fulfil with the current shortage of new vehicles due to the semi-conductor crisis, limiting global supply of vehicles.

What happens from there? WhichCar reached out to a handful of insurers to understand what their process was to try a provide a new vehicle when none are available.

RACQ spokesperson Kirsty Clinton said the process could end up being as simple as a cash settlement, allowing the policyholder to potentially look at the used car market to get around the shortage.

“If a member is entitled to a new car replacement under their car insurance policy and we can’t source an exact replacement of their vehicle, we’ll work with our member on an option that works best for them.

“We’ll discuss with our member the option of an alternative, similar vehicle which is comparable in size, price and meets their needs, alternatively the member could choose instead to take a cash settlement. What we’ve witnessed recently is the majority of members are happy to wait a few months to get their preferred vehicle.”

A spokesperson from Insurance Group Australia – parent company to NRMA and RACV Insurance – said it would also try to replace the policy holder’s vehicle but would ultimately pay the vehicle’s value if a direct replacement wasn’t available.

“If a customer is involved in an accident and we agree to pay their claim as a total loss, the customer may choose to replace their vehicle with a new one if:

- The customer’s vehicle was purchased as a new or demonstrator vehicle

- The incident we cover happens within the first two years for NRMA Insurance Comprehensive policies, or within the first 36 months for RACV Complete Care policies, from when the customer first registered their vehicle

- And the customer’s vehicle tare weight is less than 2.5 tonnes.

The semi-conductor shortage is affecting the worldwide automotive and consumer goods industry, forcing many manufacturers to idle their factories while waiting for chips to arrive.

While Australia wasn’t initially impacted by the shortage, we are starting to feel the effects of it as a number of major manufacturers such as Toyota, Volkswagen, Subaru and others have confirmed delays extending into 2022 on a range of models.

We recommend

-

News

NewsWho's got what: How the semi-conductor shortage is affecting Australia

It has been a known issue for many months now, but which models are affected and which aren't? We've got the latest information for you here

-

News

NewsStellantis boss believes semi-conductor shortage will continue into 2022

The worldwide chip supply issue is projected to drag on into next year

-

News

NewsChip shortage will impact industry for years, car company bosses warn

Amid factory shutdowns, carmakers are predicting the current situation will go on for some time yet