Snapshot

- Not all carmakers have been affected

- Some expecting things to improve in coming months, for others problems are about to hit

- Impact varies from delays to losing tech

Carmakers around the world are being forced to slow vehicle production or make adaptations to their model range in the face of a global semi-conductor shortage caused by the growing demand for personal electronics.

The world’s chip manufacturers, which ordinarily provide car factories with these components, are allocating more production to consumer electronics following the Covid-19 related slowdown in automotive manufacturing last year.

This meant that when car production ramped up again late in 2020, the same supply of chipsets was not readily available.

We’ve heard for many months about the impact on various big names here and there, but here we have the latest information on exactly how the Australian arms of the automakers are currently affected and what that means for the models headed Down Under.

Aston Martin

As yet the sportscar manufacturer has not been hit by the worldwide parts issue.

Audi

Audi says it is subject to some restrictions to supply in general, but does not have delays for specific current models at this stage.

However, it is experiencing delays for some new model arrivals. In the context of the last few years, with WLTP introduction and then Covid-19, it has confirmed such delays are not unusual.

Bentley

Good news for this British automaker, the global chip shortage has not caused significant disruption to Bentley, but it says it will continue to monitor what’s happening around the world.

BMW/Mini

The BMW Group has had to temporarily revise the specification of certain models in light of the shortfall, but has, it says, adjusted pricing accordingly.The German automaker has revealed there are three groups of cars which have had changes made as a result.

- Selected BMW 3 Series Sedan and Touring, BMW 4 Series Coupé, BMW 4 Series Convertible, BMW X3 and BMW X4 models produced in March 2021 which have lumbar support and/or seat backrest width adjustment, either as standard or as an extra, have had those features deleted from the front passenger seat and $300 knocked off the price. The driver’s seat is unaffected.

- A small number of BMW X5 xDrive30d models made in April 2021 have been changed from the standard fitment M Sport Package to the xLine Package costing $4000 less.

- The BMW 3 Series (330i and 330e Sedan and 330i Touring), BMW 4 Series Coupé (430i), BMW X3 (30i and 30d) and BMW X4 (30i) built in May 2021 will revert to Driving Assistant from Driving Assistant Professional temporarily, with $2500 taken off the bill. Driving Assistant retains aids such as emergency braking, lane change warning (including blind-spot monitor), lane departure warning and cruise control with braking function.

Ferrari

The manufacturer is keeping a close eye on what’s happening with its suppliers, but for the time being production of all models is happening as usual.

Ford

As a result of continued strong demand for its vehicles (especially the Ranger), coupled with the lack of chips, Ford says availability varies across its range and recommends customers check with dealers to find out what is and isn’t available.

It expects to have a steady supply of Rangers and Everests throughout at least the third quarter of this year, but there are waiting periods on some variants.

There’s currently stock of the Puma, but supply is now tightening, meanwhile Mustang stock is limited and there are delays on some colours and variants stretching into 2022.

Waits into early next year can also be expected on the new Escape and some variants of the Transit.

GWM/Haval

GWM hasn’t experienced any significant disruption to supply in Australia as a result of semi-conductor shortages.

Honda

Honda Australia acknowledges it has been hit by the crisis in recent months. Its current stock position remains tight, but the company says it expects to have increased arrivals in the coming months.

Hyundai/Genesis

There are no models directly affected so far, but Hyundai says it is closely monitoring the situation to “optimise production in line with supply conditions and taking necessary measures such as adjusting production schedules”.

It is also bumping up its inventory of chips by seeking more locally-produced components, new suppliers and working to preempt when it might fall short.

Isuzu

Production of the D-Max and MU-X for Australia continues as normal, however Isuzu says there are on-going supply delays – especially where demand for new, and better spec, models is high. There were 2427 D-Maxs sold here in July, currently making it the fourth most popular car Down Under, up 229 per cent on the same month last year.

The firm is watching the global issue daily and keeping dealers and customers informed of all developments.

Jaguar/Land Rover

Like other automotive manufacturers, JLR is currently experiencing some Covid-19-related supply-chain disruption which is having an impact on production.

As a result, it is temporarily limiting a number of optional features across some of its 13-strong line-up. When asked by WhichCar the company could not specify which features would be left off, except to say that vehicles which have them fitted as standard would be unaffected.

The carmaker is continuing to work closely to “resolve the issues and minimise the impact on customer orders wherever possible”.

Kia

Like sister company Hyundai, Kia also says it is monitoring the situation and taking necessary steps to adjust its production accordingly.

However it does have some specific updates regarding its current stock:

- Picanto, Rio and Niro have limited delays on all trims.

- There is availability across the model range in lower-spec choices.

- The top spec versions within the range (GT/GT-Line/Platinum) have waits of approximately three to four months.

- For the Sorento GT-Line the delay is approximately six months due to high demand globally.

Lamborghini

Lamborghini has been affected since the turn of the year, however the manufacturer says it has no direct shortage of products. The Urus and Aventador may come up against issues in the near future.

Lexus

All Lexus models currently have a wait time of between one and two months, with the exception of the LX which is three months and LC Coupe which is delayed by 12 months.

However, Lexus Australia says it has seen improved supply from its parent company in Japan so far this year.

Lotus

No current Lotus models being imported to Australia have been impacted by the semi-conductor shortage, according to the carmaker.

As for the newly released Lotus Emira, which is due to arrive here in July 2022, there is no news yet to suggest it will be adversely affected.

Mazda

All Mazda models are in good supply as Australia has been made a priority market – although the Japanese company has not been immune to the challenges faced globally.Sales have been strong for Mazda in 2021, with its best start to any year so far with almost 70,000 units shifted, earning it a top three place consistently in the new car sales charts.The new BT-50 has done well this year, with a good supply being maintained at dealers since its introduction in September 2020.

McLaren

As yet the British carmaker has not been hit by the worldwide parts issue.

Mercedes-Benz

Like many of its competitors, demand for Mercedes’s vehicles is outstripping supply. The situation is currently affecting a number of models across the range, particularly the brand’s compact vehicles (A/B/CLA/GLA/GLB) and SUVs (GLC/GLE/GLS).

Some have had adjustments made to their standard specification, which, at this time, is happening on a car by car basis.

Customers are advised to speak to their dealer for the most up to date information.

MG

MG is faring well at the moment in the battle to obtain semi-conductors. Since June the manufacturer has received more than 11,000 cars from overseas – including its largest ever single delivery of vehicles taking up a whole ship’s manifest.

However, going forward it expects there might be a small interruption to the supply of some HS variants in September, as the factory waits on more electronic modules related to the MG Pilot. The MG3 and ZS/ZST are not affected.

Mitsubishi

Currently Mitsubishi has delays on stock of around five to six months for its SUVs, and three months for 4WD versions, thanks to both semi-conductor shortages and Covid-19 related problems. The marque says there are still plenty of vehicles on dealer forecourts, so if they’re happy to shop around and don’t need to request a particular colour etc, buyers can still purchase cars without a wait.

Nissan

Unfortunately, Nissan is not immune to the global problems and says it continues to work with international colleagues to minimise disruption to production.

Although it has been hit by the shortage, which has affected output at its plant in Mexico (which does not build Australia-bound vehicles), the Japanese marque believes it will be in a stronger position over the coming months – with additional stock across its model range arriving on our shores.

Renault

The French company currently has no issues with Australia-bound deliveries.

Porsche

The German manufacturer claims the lack of parts is having an overall impact, but couldn’t confirm any issues with particular models as the situation changes too quickly.

It is doing its best to minimise direct problems, but advises customers to speak to their nearest Porsche Centre regarding specific models and specification availability.

Rolls-Royce

No news is good news for this British luxury marque.

Volkswagen/Skoda

In Volkswagen’s passenger vehicle range, there is a secure amount of the Polo, T-Cross, T-Roc and Tiguan Allspace. The Arteon, which is due to arrive soon, will have ample stock of both sedan versions but little availability of the two new Shooting Brakes until the New Year.

Volkswagen Commercial Vehicles’s primary issue relates to the Amarok, with numbers reduced by logistical delays. Large numbers of Amaroks will become available shortly.

The T6.1 range is selling fast, with the firm seeking further supply to meet demand. Meanwhile, global popularity for the Crafter range, coupled to the semi-conductor shortage, means the Crafter 35 variants will not return here in solid numbers until 2022. Crafter 50 variants however, can be delivered this year.

The new Caddy range is on sale this month.

No Skoda models are understood to be affected by the issue.

Ssangyong

SsangYong Australia’s vehicle supply has not been impacted to date.

Stellantis

Stellantis, which in Australia covers; Alfa Romeo, Fiat/Abarth/Fiat Professional, Chrysler, Citroen, Jeep, Maserati, Peugeot and Ram, says it continues to work closely with its suppliers to mitigate the manufacturing impacts caused by the various supply chain issues facing the industry.

As with Nissan, it had to temporarily shut down production in Mexico earlier this year because of the shortfall.

No models across any of the brands mentioned are specifically thought to be suffering, but boss Carlos Tavares believes the industry will be affected well into 2022.

Distributor Ateco Group told WhichCar it is aware of some delays overseas with certain Ram variants but it isn’t relevant to Australian imports at this stage.

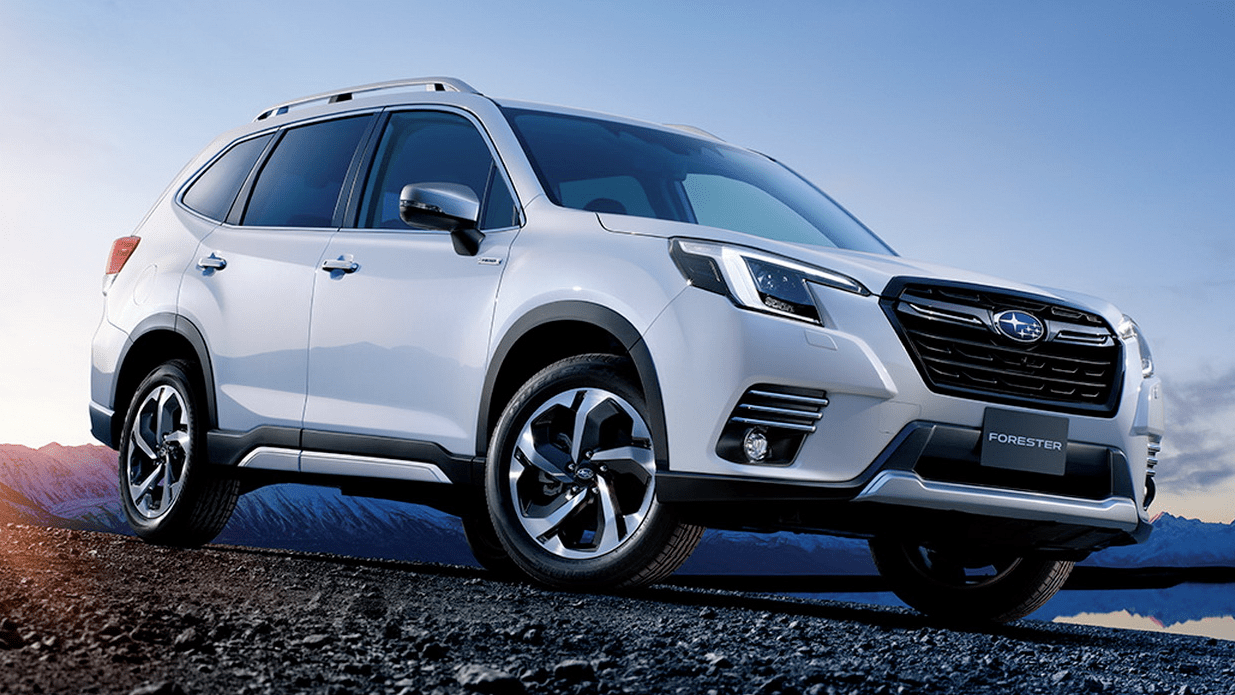

Subaru

According to Subaru, there is a wait of around three months on orders of the Outback, Forester and XV.

Meanwhile, the BRZ and Levorg have sold out ahead of their next generations arriving, and there is wholesale stock of the WRX STI which is in run-out mode.

Additionally, WRX supply is tightening up.

From around September to October the company believes things will gradually be returning to equilibrium.

Suzuki

Suzuki Australia has not responded to WhichCar‘s requests – however Suzuki Queensland, which separately imports and distributes cars for the Queensland and northern rivers region of New South Wales, said it has experienced issues related to a lack of semi-conductors.

Though its sales are up 75 per cent year-to-date to the end of July, demand is expected to exceed availability throughout the third and fourth quarters of 2021 and the firm says it “would be unrealistic to expect those increases to be sustained”.

Forward orders have been cut and as a result, the QLD branch has actively sought to offset the impact by introducing new options such as the Jimny GL Lite in manual guise – which has a lower spec than the GLX model and thus reduces wait times.

Dealers in the Sunshine State still have stock of the Swift, Ignis, Baleno, S-Cross and Vitara, but the company is advising customers to allow for delays when making purchase decisions.

Toyota

The Japanese car giant says demand for its vehicles, both globally and in Australia, has recovered much faster than anticipated and largely it has cruised past the problems influencing its rivals. Toyota Australia has experienced particularly strong demand since the middle of 2020, with Australians choosing to buy almost 120,000 of its new cars – an increase of 21.7 per cent over the same period last year.

However, for some models and accessories, this high demand has resulted in longer than usual delivery times. Semi-conductor availability has been, and continues to be “managed through careful forward planning”. It added that it will continue to provide the latest information to customers about their orders through dealers.

Volvo

So far the Swedish marque’s Australian arm has been given everything it has asked for from the factories overseas.

It is expecting all requests for stock to arrive as planned, including the soon to be introduced Volvo XC40 Recharge Pure Electric.

We recommend

-

News

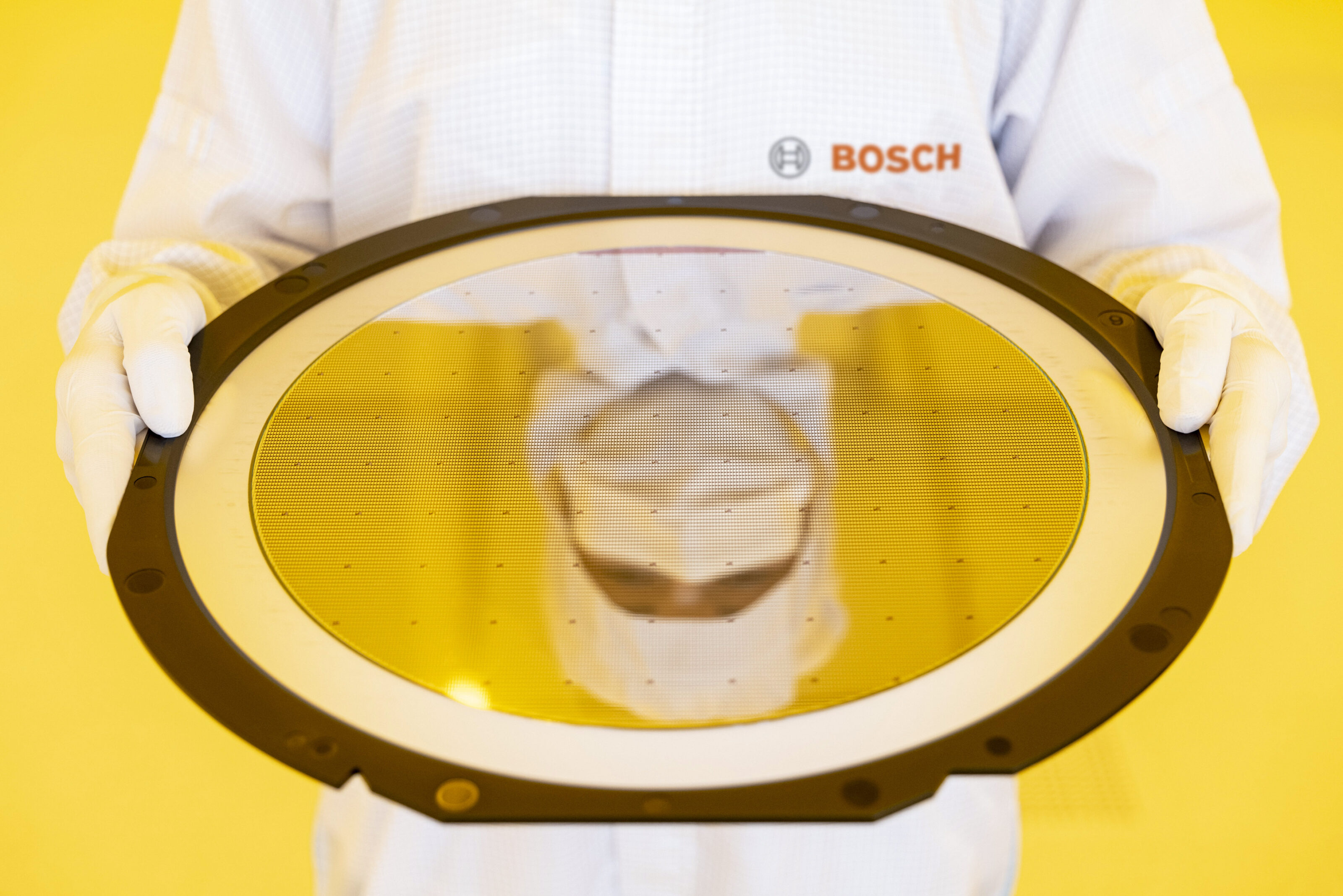

NewsBosch set to open new semi-conductor factory

German technology giant will start manufacturing in July with automotive production beginning in September

-

News

NewsStellantis boss believes semi-conductor shortage will continue into 2022

The worldwide chip supply issue is projected to drag on into next year

-

News

NewsGlobal semi-conductor shortage not an ‘issue’ for Toyota

Toyota Australia VP says clever planning has fortified the Japanese marque despite the tech shortage