No one saw Tesla coming. A Silicon Valley start-up putting electric motors into a handful of Lotus sportscars was about a niche as car-making gets.

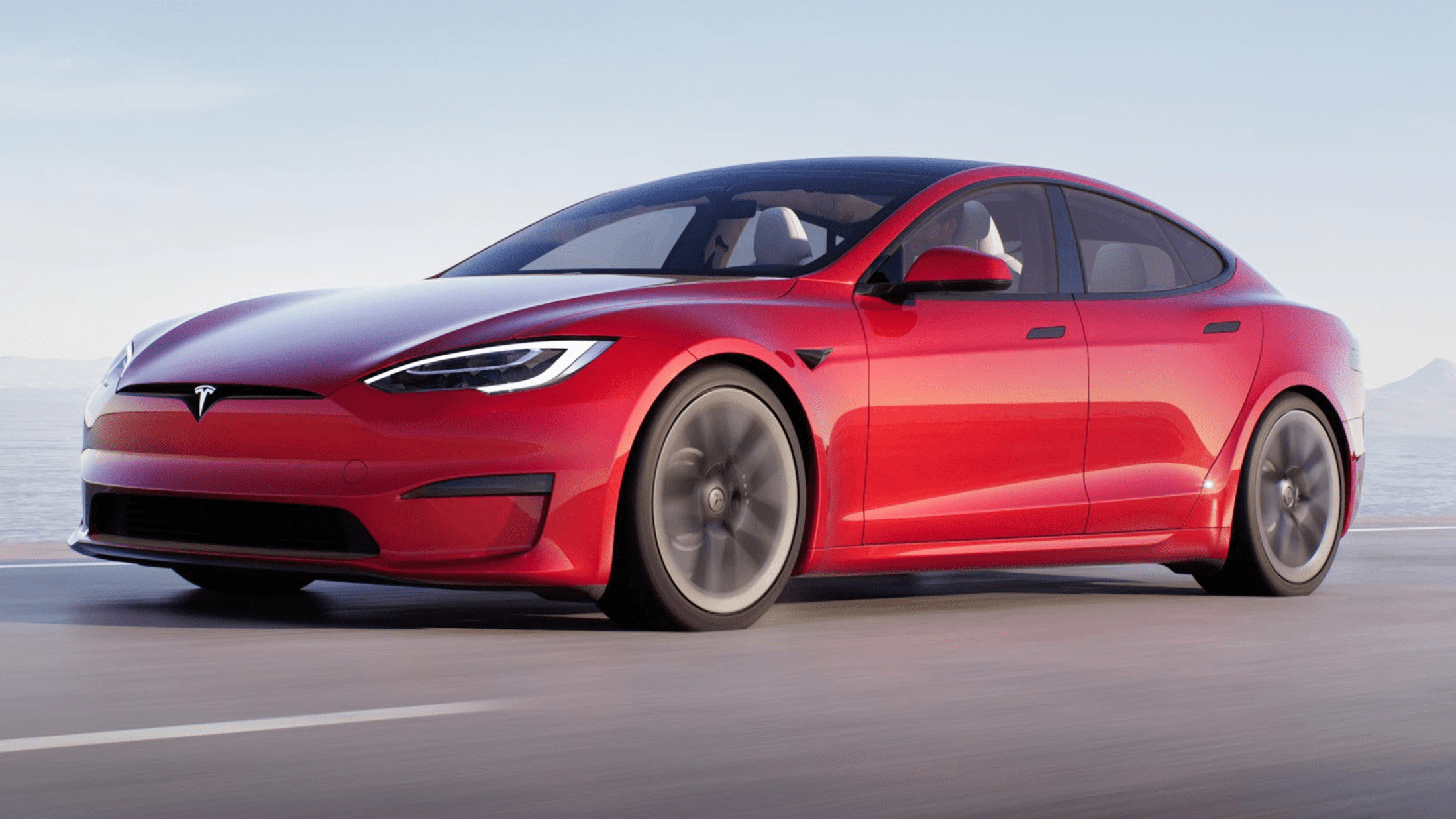

Then Elon Musk took over. Scarily smart, and with the balls to simultaneously bet billions on two industries with staggeringly high costs and razor-thin margins – space travel and car manufacturing – Musk saw an opportunity. In the same year his space company, SpaceX, launched its first rocket, Tesla launched the Model S, a car that changed the way the world thought about electric vehicles.

Elon Musk’s masterstroke, however – the real genius of the Tesla business model – was to create an ecosystem within which the Model S could legitimately function as an alternative to a vehicle with an internal combustion engine. Tesla’s Supercharger network made the Model S a real car, not a novelty.

Part 2!

March 2023: This story is now part one in a two-part series. When you’re finished reading this one, you’ll find a link at the bottom to continue onto part two.

JUMP AHEAD

Australia’s best electric cars for 2023

We’ve tested nearly every EV below six figures in Australia to rank the best on sale today

Tesla sold just under a million vehicles last year.

It’s also the first genuinely new premium automotive brand – as opposed to an artificially created one such as Lexus – to emerge in decades, its cars outselling similarly priced vehicles from traditional premium brands such as BMW and Mercedes-Benz in lucrative markets such as the United States.

Look past the headlines, though, and Tesla has some big challenges ahead.

Tesla’s total share of the global EV market last year may have been almost 20 per cent, but just two models, the Model 3 sedan and Model Y SUV accounted for 97 per cent of its sales.

The car that kickstarted it all, the Model S, is now nine years old, with no replacement in sight. The Model X SUV, now six years old, still has its heavy, complex, and troublesome ‘Falcon Wing’ rear doors.

The much-hyped Tesla Cybertruck ute Musk claimed would be in production in 2020 has been delayed until next year at the earliest. References to the next Tesla Roadster, unveiled as a high-performance flagship in 2017, have quietly disappeared from the Tesla website.

More significantly, the automotive establishment is starting to fight back, using skills and resources accumulated by decades of designing and manufacturing the most complex consumer products ever created. By 2030, traditional manufacturers will each be producing dozens of EV model lines and chasing EV sales targets in the millions.

Hyundai Motor Group, for example, plans to offer 11 Hyundai-branded EVs, six Genesis-branded ones, and 14 Kia EVs by 2027. It is targeting global sales of three million EVs by 2030.

Volkswagen Group, which last year sold 8.6 million vehicles worldwide, expects EVs to account for half its global sales by the end of the decade. GM says it plans to launch 30 new EV models in the next three years.

In total, traditional car-makers are set to splurge more than US$515 billion on EV research and development this decade. Tesla, by contrast, has spent less in total vehicle R&D since 2008 than Toyota and Mercedes-Benz each spent in 2020 alone.

The traditional OEMs are poised to outspend and out-produce Tesla, a company that’s still struggling to build cars at volume and to high levels of quality.

More troubling for Tesla, though, are the new and emerging car-makers that are looking to follow in its wheel tracks, many using near-turnkey EV powertrains and battery packs developed and sold by a growing legion of suppliers. The car industry’s arch-disruptor is a role model for a whole new generation of disruptors.

Here are some to watch for.

XPeng

Based in Guangzhou, China, XPeng was founded in 2014 by two former senior executives from Chinese car-maker GAC and Chinese tech billionaire He Xiaopeng.

By the end of this year, it will be producing and selling four EVs in China. XPeng already sells one of its models in Norway and plans to increase exports to other European countries and the US over the next few years.

XPeng’s four models are built off two platforms. The smaller platform, designed for vehicles with wheelbases from 2600mm to 2800mm and codenamed David, underpins the G3i compact SUV currently on sale in Norway, and the P5, a Chinese-market compact four-door sedan that features a long wheelbase and ultra-roomy rear seat. Both are available with a single motor driving the rear wheels, or dual motors and all-wheel drive.

The XPeng P7, a sedan with Tesla Model S styling cues, is built on the Edward platform, which is designed for vehicles with wheelbases from 2800mm to 3100mm. Developed in conjunction with Porsche, it features multi-link suspension all round.

The single motor P7 RWD Long Range is powered by a rear-mounted e-motor that develops 196kW and 390Nm of torque. The dual-motor P7 4WD High Performance packs a total system output of 316kW and 655Nm.

XPeng’s Edward platform also underpins the company’s newest model, the G9 SUV, which goes on sale in China in the third quarter of this year and is rumoured to be destined for the US. The G9 features an 800V electrical architecture that will allow fast charging.

It’s taken eight-year-old XPeng less than half the time Tesla took to get four vehicles into production and on sale. But the Chinese company’s biggest threat could be its end-to-end software architecture, a technology concept that has hitherto been unique to Tesla in the automotive sector.

Dubbed Xmart OS and initially Android-based but now highly evolved and unique, it controls driver assistance systems as well as connectivity functions and infotainment systems. The system also supports AI capabilities, including a ‘Hey XPeng’ voice activation function and a smart navigation system and allows over-the-air updates and remote vehicle diagnostics.

VinFast

VinFast was founded in 2017 and though headquartered in Singapore, is part of Vingroup, the largest private company in Vietnam.

A US$39 billion conglomerate with interests in real estate and the leisure industry, Vingroup is owned by Pham Nhat Vuong, who got his start selling ramen noodles in Ukraine in 1993.

Founded as a maker of conventional internal combustion engine vehicles, VinFast announced in 2020 that it would switch to producing pure EVs within two years. Chairman Pham Nhat Vuong reportedly personally underwrote the cost of the design and engineering changes required for the two internal combustion engine vehicles the company had under development at the time.

Those vehicles, the VinFast VF 8 mid-size SUV and the larger VF 9 three-row SUV, have just entered production in Vietnam and production of export models for the US market is imminent.

The VF 8 will be available in the US in two trim levels – Eco and Plus. Both are dual-motor, all-wheel drive models, the Eco offering 260kW and the Plus 300kW. VinFast claims a 0-100km/h acceleration time of about 6.0 seconds for the Eco, and 5.5 seconds for the Plus.

Two battery sizes will be offered, the Standard Range delivering an estimated 418km range on the WLTP cycle in the Eco and 400km in the Plus. The Enhanced Range battery boosts those numbers to 470km and 455km respectively.

VinFast has announced VF 8 pricing will start at US$40,700 – plus a monthly battery subscription fee of US$110. Customers who don’t travel long distances can pay just US$35 a month for 498km worth of travel each month, with each additional kilometre being charged at the rate of 18 cents.

VinFast’s idea behind the subscription fee is to keep initial purchase costs down – batteries are expensive – and to reassure buyers. Though VinFast is offering a 10-year/200,000km warranty in the US, the subscription deal means it will replace the battery if its storage capacity degrades below 70 per cent.

The VF 9 will be priced from US$55,500, with a battery subscription fee of US$160 per month, or a flexi rate of US$44 a month for 498km with each additional kilometre costing 24 cents.

A VF 9 can be configured as a six- or seven-seater and will also be available in Eco and Plus trims, but unlike the VF 8, both come with the 300kW dual-motor powertrain.

The Standard Range battery pack gives claimed a 0-100km/h acceleration time of about 7.4 seconds for both Eco and Plus versions, with respective claimed WLTP ranges of 438km and 422km.

The Enhanced Range battery delivers a claimed 0-100km/h time of about 6.5 seconds and claimed range of 594km in the Eco model, and 6.6 seconds and 580km in the Plus version, which comes standard with larger 21-inch diameter wheels.

VinFast has three new EVs scheduled for launch by 2024 – the VF 7 compact SUV, the VF 6 hatchback and VF 5 city car, all of which are aimed at European and Asian markets.

This ultra-rapid product rollout and aggressive pricing strategy aren’t the only things Tesla should worry about. VinFast has just announced it is spending $2.8 billion on a new factory in the US to manufacture VF 8 and VF 9 models specifically for Tesla’s home market. The factory will have the capacity to produce 150,000 vehicles a year.

BYD

Chinese entrepreneur Wang Chuanfu founded BYD in 2003 to build cars, trucks, and buses.

The initials stand for “Build Your Dreams”, though industry wags quickly changed that to “Borrow Your Designs” after the company’s early cars featured styling egregiously cribbed from brands such as Mercedes-Benz, Renault, and Toyota.

BYD has already toppled Tesla as the world’s biggest producer of EVs, with reported sales of 641,000 vehicles for the first six months of this year, compared with Tesla’s 564,000 units.

What’s more, the company, which is part-owned by billionaire American investment guru Warren Buffett’s Berkshire Hathaway Inc., has also overtaken South Korea’s LG as the world’s second-biggest producer of EV batteries, behind China’s CATL.

Dominant in China, the world’s largest car market, BYD is planning to go global – having already started in Australia with its Atto 3 crossover – and its product pipeline is full of models aimed at export markets in Europe and North America.

BYD’s second-generation, seven-seat Tang SUV is a convergence-platform vehicle that can be built with a conventional internal combustion engine, as a plug-in hybrid, or with a full battery electric powertrain. It is already being marketed in Europe.

The all-wheel drive, dual-motor version of the Tang packs 380kW and 680Nm of torque, enough to scoot the 2489kg SUV from rest to 100km/h in a claimed 4.6 seconds.

JUMP AROUND

Its 86.4kWh battery gives a claimed 400km range on the WTLP combined cycle and will accept a 110kW DC charge rate, enabling the battery to be topped up from a 30 per cent charge to 80 per cent in 30 minutes.

BYD’s Han EV sedan went on sale in selected Latin American and Caribbean countries last October.

Launched in 2020 and recently facelifted, the Han EV is available in China with a single 163kW motor driving the rear wheels, or as a dual-motor model with a 200kW front motor bringing the car’s total system output to 363kW. The rear-drive car is said to hit 100km/h in 7.9 seconds, while the dual-motor car is claimed to be able to nail the sprint in just 3.9 seconds.

BYD’s existing sales and manufacturing strength has obvious implications for Tesla’s growth ambitions.

Tu Le, managing director of advisory group Sino Auto Insights, recently told Britain’s Financial Times newspaper that BYD was “firing on all cylinders,” with products covering many critical EV market segments. He said he also expected BYD to soon challenge foreign carmakers on their home turf, especially in the US.

“They’re going to make some really aggressive moves to go international.”

Polestar

Polestar started life as a Volvo race car builder and tuner. China’s Geely, which acquired Volvo in 2010, decided to make it the company’s dedicated premium EV brand in 2017. Polestar has since been spun off from Volvo and Geely via a merger with a US-based special purpose acquisition company, Gores Guggenheim, which raised US$890 million.

Its first EV, the Polestar 2, is built on a version of the platform that underpins Volvo’s XC40, among others, and aimed squarely at Telsa’s Model 3. Forthcoming Polestar models are aiming way higher than that.

First up is Polestar 3, a rakish, high-performance SUV built on a bespoke EV platform, aimed squarely at Porsche Cayenne customers.

Due to go on sale later this year, the 3 will come with a dual-motor powertrain fed by a large battery pack that will deliver a range of 600km. It will also come with hardware and electronics, including a LiDAR system, that Polestar says will enable autonomous highway driving by 2025.

Polestar 3s for the North American market will be built at Volvo’s factory in South Carolina and the company expects it to be instrumental in increasing global sales to 290,000 units by 2025, a ten-fold increase over 2021’s total.

Following in 2023 will be the Polestar 4, another SUV, but this one aimed at Porsche’s Macan. And 2024 will see the launch of …wait for it… the Polestar 5, a high-performance four-door GT fastback inspired by the stunning Polestar Precept concept unveiled in 2020.

The Polestar 5’s target is the Porsche Panamera, and like the other Polestars, the car will be built in Geely-owned plants in China. Boasting 650kW and 900Nm, the dual-motor Polestar 5 will debut a new dedicated platform and will feature a very rigid bonded aluminium spaceframe and an 800V electrical architecture to allow ultra-fast charging.

Polestar has also confirmed it will bring the O2 roadster concept into production, badged Polestar 6, quickly finding takers for the first 500 examples.

You may have noticed a theme here: Polestar is unashamedly targeting Porsche with high-quality, beautifully designed, upscale cars.

But that strategy is also a problem for Tesla, which has found itself regarded as a premium EV manufacturer.

Part of this is because it was a first mover in the space, with vehicles that attracted wealthy early adopters. But it’s also because it has subsequently been unable to produce vehicles at the much lower prices the company originally promised.

Teslas are expensive. And unless Tesla has a robust plan to redesign existing models and release new ones over the rest of this decade, it’s in danger of being swamped by a swarm of brands offering EVs that look fresher or feel more luxurious or are simply better value.

“Production is hard. Production with positive cash flow is extremely hard.” Elon Musk tweeted this in 2021.

Welcome to the car business, Elon. And it’s not going to get any easier.

March 2023: The Empire Strikes Back

The story you’re reading right now, focuses on incoming threats from new brands. But will Tesla fans still favour Elon’s ‘disruptor’ when old-fave legacy brands become more and more competitive in EVs? Read part two here of Tesla Killers at the link below.

⚡ More EV stories to help you choose the best car for your needs

We recommend

-

News

News2023 Polestar 3 electric SUV revealed ahead of Australian debut

Polestar reveals new images of its Polestar 3 electric sports SUV that will take on the likes of the Audi E-Tron and Porsche Cayenne.

-

News

NewsBYD Seal / Atto 4 electric sedan spied in Sydney ahead of coming launch

The mid-size electric sedan has just gone on sale in its domestic market, ahead of an expected Australian launch in early 2023

-

News

NewsNew car calendar 2026: All the new cars coming to Australia next year

Here’s the WhichCar by Wheels guide to all the new cars that will launch in Australia in 2026. Check back in regularly for updates...