How can electric cars get cheaper when battery costs have risen?

EV batteries are expensive. It’s the Achilles heel that’s keeping new electric car prices high – and battery prices have increased, as demand grows for supply-limited raw materials such as lithium and cobalt.

Snapshot

- Sodium-ion batteries seen as the new solution for EVs

- Demand for lithium overtaking supply for the foreseeable future

- But LFP, Li-ion appears to still remain dominant

JUMP AHEAD

- ? Why do we need another new battery option?

- ? How about solid-state batteries?

- ? What do sodium-ion batteries contain?

- ? How are sodium-ion batteries cheaper?

- ?️ When will sodium-ion batteries be released?

- ? Is it time to make the electric switch?

? Why do we need another new battery option?

Carmakers such as Tesla, BYD and MG have already adopted the longer-lasting and thermally safer lithium-iron-phosphate (LFP) cathode chemistry, but it still isn’t flawless.

On the plus side, LFP doesn’t use contentious cobalt and nickel materials, making them around 20 per cent cheaper than regular lithium-ion nickel-manganese-cobalt (NMC) packs, according to BloombergNEF [↗].

Yet, LFP batteries were still hit by a 27 per cent price rise in 2022 compared to 2021 – where demand overtook supply for the first time.

It’s caused by the increased demand for mining lithium – resulting in an EV battery shortage, as demand outstrips supply to more drivers buying electric vehicles.

While some automakers and the International Energy Agency [↗] have said market costs started to lower again in 2023, BloombergNEF [↗] expected it to start dropping in 2024 as more extraction and refining facilities open – in addition to developing better recycling processes.

Mercedes-Benz chief executive Ola Källenius told Reuters [↗] that EVs will remain more expensive “for the foreseeable future” due to varying costs in battery raw materials, software development and electricity prices – despite targeting a ‘significant cost reduction’ for the forthcoming CLA electric sedan and using LFP for entry variants.

? How about solid-state batteries?

Solid-state batteries are mooted as the ‘ultimate’ solution for EVs to address concerns around driving range, weight and, importantly, thermal safety.

But, they aren’t expected to come to market until at least 2025 – and it’ll be even longer before they’re a properly affordable proposition.

In the interim, MG’s director of battery development, Ge Hailong, told WhichCar that it’s developing a half solid-lithium hybrid pack to debut in 2025 that’s even cheaper and longer-lasting than LFP.

Meanwhile, some major carmakers including Hyundai, Toyota and BMW have also invested in developing hydrogen fuel-cell powertrains – which has its own benefits, but is still significantly less efficient to produce and drive an EV than pure battery.

? What do sodium-ion batteries contain?

Enter sodium-ion (Na-ion) batteries, seen as a cheaper and even more sustainable alternative to LFP.

| EV battery material makeup | Sodium-ion (Na-ion) | Lithium-ion (Li-ion) |

|---|---|---|

| Cathode (positive terminal) | Sodium | Lithium |

| Electrolyte (separator) | Sodium | Lithium |

| Anode (negative terminal) | Hard carbon | Graphite |

| Current collector (outside each cathode/anode electrode) | Aluminium | Aluminium (for cathode), copper (for anode) |

Sodium-ion cells share a similar construction and alkali metal properties with Li-ion, albeit being slightly heavier and bigger.

The anode’s hard carbon material allows a broader range of available electrolytes, resulting in a wider operating temperature range and ultimately makes it safer to use (more on that below).

? How are sodium-ion batteries cheaper?

Sodium is expected to be up to 40 per cent cheaper than lithium, due to abundant supply, and lower extraction and purification costs.

| Sodium-ion (Na-ion) | Lithium-ion (Li-ion) | |

|---|---|---|

| Energy density | u223c100-150Wh/kg (potential for 200Wh/kg+) | u223c150Wh/kg for LFP, up to 275Wh/kg for NMC cathodes |

| Battery pack cost | N/A u2013 expected to be 20% to 40% cheaper than Li-ion | u223cAU$220 per kWh (2022 average) |

| Operating temperature | -30 to 60u00b0C | 15 to 35u00b0C |

| Safety | Lower thermal runaway risk; can be transported with no risk as it can be fully discharged | Thermal runway risk (but lower for LFP cathode); cannot be under 30% during transportation |

| Recyclability | Less raw materials included; simpler recovery process | Separating metals needed; more complex process |

Note: Data collated from C&EN research, BloombergNEF, Faradion, pv magazine, Digitimes Asia, Ecotreelithium, and the International Energy Agency.

Critically, sodium-ion tech lacks expensive raw and environmentally unsustainable materials such as lithium, cobalt, copper and graphite – which are in short supply due to slow mining processes not keeping up with the increasingly strong demand.

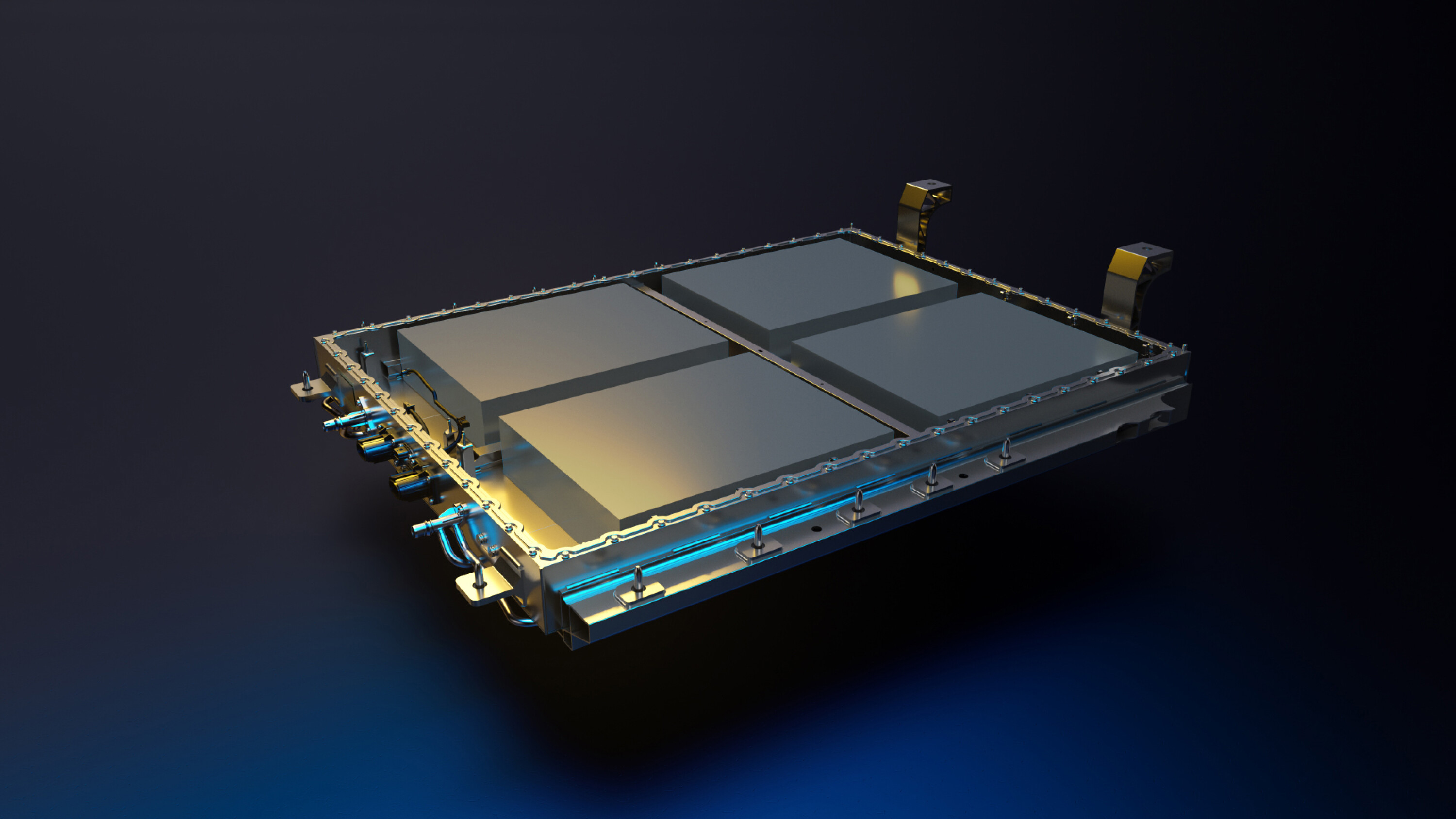

For the world’s largest EV battery maker, Contemporary Amperex Technology (CATL), it claims its sodium-ion pack provides similar safety and longevity to LFP, with faster charging capabilities and better low temperature performance – but is less energy dense (i.e. less driving range), at least in first-generation form.

Sodium-ion battery producer Faradion [↗] claims the electrolytes are more stable than lithium-ion, and its own testing demonstrates no fire reaction when penetrated with a nail.

That’s similar to BYD’s LFP Blade Battery claims, but according to the British company, sodium-ion still outputs significantly less heat.

When completely discharged (at zero volts), its peer-reviewed research [↗] demonstrates the risk of thermal runaway from short-circuiting is eliminated – which is ideal for transporting EVs in cargo ships en masse, for example.

?️ When will sodium-ion battery EVs be released?

Sodium-ion batteries are already being produced, but the question is when they’ll debut in mass-market electric cars globally.

Cheaper manufacturing costs and the initially lower energy density than LFP means they’ll be found on more affordable, entry-level models with shorter driving ranges.

Chinese automaker BYD intends to introduce sodium-ion tech on its Seagull micro electric car soon in a cheaper base variant, but it’s only sold in China for now.

Similar to BYD, CATL has already released its own Na-ion batteries in 2021 and plans to ramp up production this year to debut in a Chinese-market Chery EV. But, it may initially take a hybrid sodium-lithium approach, according to local media reports (via Electrive [↗]).

British startup Faradion has been developing sodium-ion batteries since its inception in 2011. Its batteries are already in production, with the first commercial energy storage battery installed in Australia in late 2022.

While lithium-ion battery prices have increased, sodium-ion packs have emerged as the new solution to reduce manufacturing costs, rely less on environmentally unsustainable raw materials – a further reduction from LFP – and offer better thermal safety to ultimately lower the cost barrier to electric vehicle adoption and address contentious issues.

Despite this, if it does reach the masses, it may take some time with most major automakers still favouring LFP today for entry-level EVs – especially in China, where the majority of LFP packs are manufactured (according to Asia Financial [↗]).

? Is it time to make the electric switch?

Are electric cars truly sustainable – if the batteries contain raw materials and are mainly charged from a coal-fired electricity grid? Check out our comprehensive guides below for everything electric cars.

We recommend

-

News

NewsBYD may launch first sodium-ion battery electric car in 2023

The first mass produced sodium-ion battery EV could come from BYD’s new EV city car next year

-

News

NewsLithium hits record price, may affect electric vehicle costs

A component of EV batteries has gone up in price, and new-car buyers could be left with the bill