In the second article of our two-part 2021 half-term sales report series (you can read part one here), we continue to find out which brands are winning or losing in Australia’s new-car sales race.

We start with Japanese luxury brand Lexus…

Lexus: Up 14 per cent – small winner

Best-selling model: NX mid-sized SUV (1842 sales; down five per cent)

Fastest-growing model: IS sedan (746 sales; up 144 per cent)

Toyota’s renowned challenger brand to the German luxury car makers remains well behind Audi, BMW and Mercedes in Australia, though it at least has the next-best growth after Audi. Its most popular model, the NX SUV, is down five per cent on its sales this time last year, though a second-generation model is coming later in 2021.

There are upward trajectories for the UX compact crossover (up 23 per cent) and big, LandCruiser-based LX (up 25 per cent), though the RX large SUV is static with less than one per cent growth. Lexus’s biggest-growing model ironically is the IS sedan – up 144 per cent but being axed later in 2021 despite the introduction of a ‘new generation’ model only last year.

Maserati: Up 26 per cent – winner

Best-selling model: Levante SUV (210 sales; up 35 per cent)

Fastest-growing model: Ghibli sedan (72 sales; up 41 per cent)

Italian luxury brand Maserati is almost on par with the market’s 28 per cent year-to-date growth. Its only SUV for now, the Levante, remains its best-selling model.

Mazda: Up 56 per cent – big winner

Best-selling model: CX-5 mid-sized SUV (15,290 sales; up 50 per cent)

Fastest-growing model: CX-8 large SUV (3524 sales; up 216 per cent)

Perhaps the most impressive aspect of Mazda’s 2021 so far is that not a single model has gone backwards in sales. While the 4×2 variant of the BT50 is down 16 per cent, huge growth for the 4×4 version (up 90 per cent) ensures the ute’s overall sales are up 60 per cent.

Mazda’s SUVs are all rushing out of showrooms in bigger numbers compared with January-June 2020, including the 2021 Wheels Car of the Year (COTY) – the Mazda CX-30 – which has doubled sales. The midsized CX-5 is up 50 per cent and currently the country’s second most popular SUV behind the Toyota RAV4. There’s even good news for the brand’s sole sports car: the MX-5 is up to 444 sales, a 140 per cent increase.

Mercedes-Benz: Up four per cent – small winner

Best-selling model: C-Class mid-sized car (2314 sales; up 58 per cent)

Fastest-growing model: GLB SUV (2006 sales; up 842 per cent)

Mercedes-Benz passenger cars and SUVs are up 12 per cent year to date, though the figure shrinks to four per cent when the German brand’s commercial vehicles are included. (They are separated in VFACTS statistics.) The 30 per cent decline for Mercedes’s Vans division can be attributed to a simple factor: the axing of the X-Class ute.

With such a vast range, it’s no surprise there’s a mixture of ups and downs when it comes to sales. The A-Class is the most notable negative, with sales down by a third – with buyers seemingly moving into the SUV that’s based on the luxury hatch: GLA sales are up by nearly a third.

The GLB seven-seater SUV that’s also related to the A-Class is the stand-out performer with a staggering 842 per cent increase, which has taken it to more than 2000 units so far for the year. The electric EQC SUV is also doing well – up 123 per cent to 127 units – while the C-Class remains the brand’s best-selling model and up 58 per cent despite the looming arrival of a next-generation model.

MG: Up 240 per cent – big winner

Best-selling and fastest-growing model: ZS compact SUV (9093 sales; up 434 per cent)

The relatively recent surge of Chinese-brand sales is no better represented than by MG, the former British sports car marque. With 240 per cent year-to-date growth, MG has sold nearly 20,000 vehicles so far in 2021 – with just three models. That’s a figure which puts it in close company with Subaru and Volkswagen.

The ZS compact SUV is both the best-seller and fastest-growing MG, though the HS midsized SUV is up 209 per cent and the MG3 city car is up 140 per cent. MG is now starting to appear in monthly top 10 brands charts. Continue to watch this space.

Mini: Up 35 per cent – winner

Best-selling model: Hatch (1010 sales; up 37 per cent)

Fastest-growing model: Countryman SUV (761 sales; up 50 per cent)

A solid year so far for the BMW-owned British premium small-car brand, with all four of its models posting growth – the biggest of which belonging to Mini’s only SUV.

Mitsubishi: Up 30 per cent – winner

Best-selling model: Triton ute (13,176 sales; up 37 per cent)

Fastest-growing model: Express van (549 sales; up 266 per cent)

Mitsubishi experienced a disappointing June (down 24 per cent), though the Japanese brand has otherwise been a regular fixture among the top 10 brands this year. And for the first half of the year, it’s tracking just above the growth of the overall market. The Triton ute is up 37 per cent and remains untouchable as the most popular Mitsubishi.

The ASX compact SUV continues to defy its age as the second-best-selling model, with 7275 sales (up seven per cent). The Express van is also defying its disappointing crash-safety rating to be the company’s fastest-growing model. Every model in the line-up sits in the growth column, including the Eclipse Cross compact SUV (up 68 per cent), Mirage city car (up 79 per cent), and the Pajero off-roader which has doubled sales year to date.

Nissan: Up 28 per cent – winner

Best-selling model: X-Trail mid-sized SUV (8742 sales; up 28 per cent)

Fastest-growing model: Juke compact SUV (1307 sales; up 429 per cent)

Nissan slipped to ninth place in the manufacturer rankings in June but otherwise 2021 is progress – matching the 28 per cent overall market growth. Even the company’s two sports cars have increased sales – 370Z up 15 per cent; GTR up 55 per cent – though numbers are insignificant of course next to Nissan’s ute and SUV range.

X-Trail sits atop the brand’s sales ladder and is increasing sales (up 28 per cent) ahead of a fourth-generation version coming in 2022. Nissan’s smallest SUV and freshest model, the Juke, is the biggest mover – up an astonishing 429 per cent.

Peugeot: Up 17 per cent – small winner

Best-selling model: 3008 mid-sized SUV (355 sales; down 17 per cent)

Fastest-growing model: 2008 compact SUV (272 sales; up 319 per cent)

The second-generation 2008 compact SUV, introduced in the second half of 2020, has been the biggest contributor to Peugeot’s local sales – with a mighty 319 per cent growth mostly responsible for the overall increase of 17 per cent. Peugeot’s Expert and Partner vans have also chipped in – up 60 and 111 per cent, respectively. Despite updated versions introduced for 2021, though, the 3008 mid-sized SUV and 508 sedan have both lost sales compared with this time last year.

Porsche: Up 21 per cent – small winner

Best-selling model: Macan midsized SUV (1422 sales; up 19 per cent)

Fastest-growing model: Taycan electric sedan (369 sales; not sold this time last year)

Porsche’s first ever fully electric model has made a great start – establishing itself as the German brand’s second most popular model after the runaway Macan SUV. The Panamera large car has enjoyed triple-digit growth (up 109 per cent), the Boxster convertible has closed the sales gap to its coupe twin, the Cayman, with 44 per cent growth, and the iconic 911 is up slightly (by six per cent).

The Macan currently accounts for more than half of Porsche’s sales in Australia. It’s not good news for its other, larger SUV: Cayenne sales are down by more than 40 per cent.

RAM Trucks: Up nine per cent – small winner

Best-selling and fastest-growing model: RAM 1500 (1885 sales; up 10 per cent)

The Ateco and Walkinshaw partnership established in 2015 to distribute (former) and build (latter) continues to be a success story in 2021, even if growth isn’t quite as dramatic as it was in 2019.

Renault: Up 33 per cent – winner

Best-selling model: Trafic van (1210 sales; up 54 per cent)

Fastest-growing model: Captur compact SUV (240 sales; not sold in 2020)

More good news for Ateco, which acquired the distribution rights for Renault earlier this year. The French brand has been struggling in recent years despite its official, factory-backed presence in Australia, but year-to-date sales are up by a third (33 per cent). While showroom traffic has been boosted by the arrival of a second-generation Captur compact SUV, Renault’s van range is doing most of the hard yards.

The Kangoo is up 62 per cent, Master is up 12 per cent, and the best-selling Renault locally, the Trafic, is up 54 per cent. One disappointment is the Megane RS, which is down nearly 60 per cent despite most of its hot-hatch rivals selling well this year.

Skoda: Up 105 per cent – big winner

Best-selling model: Kodiaq large SUV (1232 sales; up 41 per cent)

Fastest-growing model: Superb large car (372 sales; up 318 per cent)

Skoda is the fastest-growing VW Group brand in Australia right now, with impressive triple-digit growth. Sales have been boosted by the arrival of two (related) all-new cars – the Scala hatchback and the Kamiq compact SUV – while a new-generation Octavia is also fresh and looking to re-establish itself as Skoda’s best-selling model.

That title currently belongs to the Kodiaq large SUV. The Superb large car, which was given an expanded range in late 2020, is enjoying sales growth of nearly 320 per cent. Even the Fabia city car – due to be replaced by a next-generation version in early 2022 – is up 33 per cent.

Ssangyong: Up 117 per cent – big winner

Best-selling model: Musso ute (916 sales; up 142 per cent)

Fastest-growing model: Rexton large SUV (304 sales; up 182 per cent)

SsangYong can claim to have the biggest growth of any Korean car maker in Australia at halftime in 2021. Sales are up 117 per cent to 1421 units – stemming from just three models. The Musso ute is the most popular vehicle by a huge margin, though its 142 per cent year-to-date increase is surpassed by both the Korando mid-sized SUV (up 154 per cent) and Rexton large SUV (up 182 per cent).

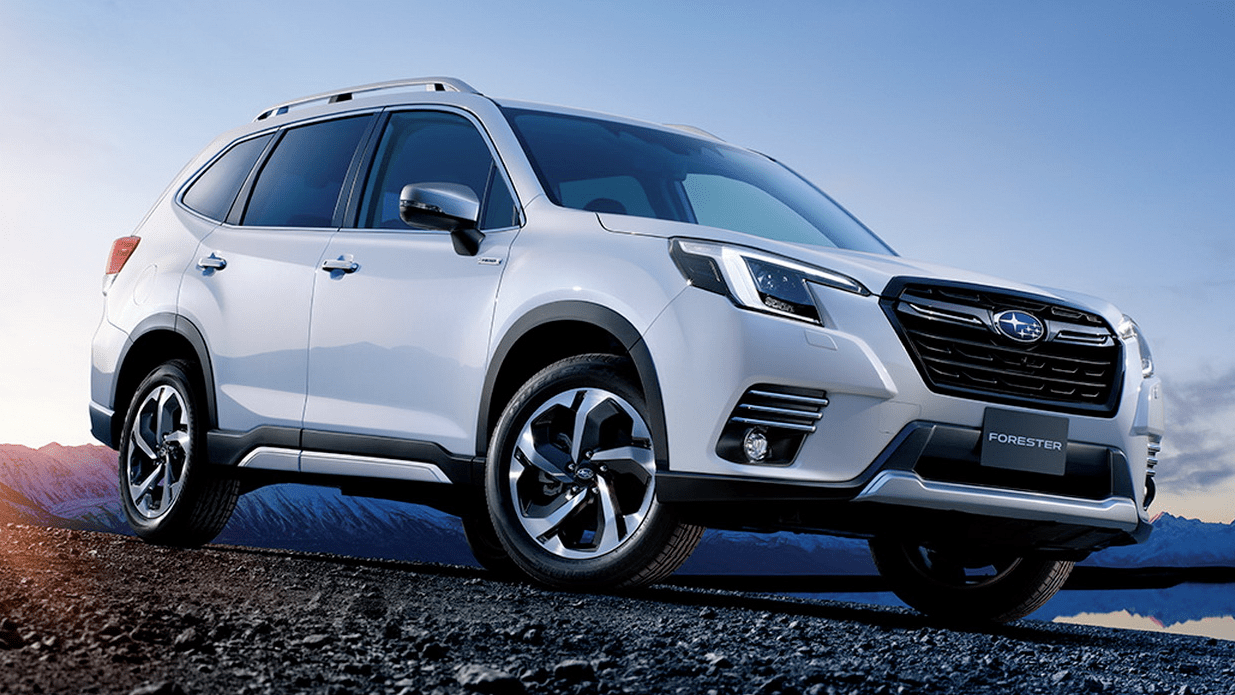

Subaru: Up 34 per cent – winner

Best-selling model: Forester mid-sized SUV (7086 sales; up 23 per cent)

Fastest-growing model: Outback wagon (4820 sales; up 110 per cent)

Subaru has been in and out of the top 10 brands list during the first six months of 2021 but there’s no doubt the Japanese marque is savouring a strong year so far, passing 20,000 units. The Forester maintains its enduring popularity in Australia, as does another model.

The sixth generation of the Outback high-riding wagon was released earlier this year and sales are up 110 per cent. Even older models are performing reasonably well, with the Impreza small car and its related XV small SUV both up – 27 and 20 per cent, respectively. Even the sportier WRX is up 61 per cent, ahead of a next-generation version being unveiled this year. The Liberty sedan is down 39 per cent, but that’s to be expected for a car which has – sadly – been discontinued.

Suzuki: Up 30 per cent – winner

Best-selling model: Swift city car (2688 sales; up 16 per cent)

Fastest-growing model: Ignis (902 sales; up 421 per cent)

Good work from Japan’s famous small-vehicle specialist, which is just above the overall market’s 28 per cent year-to-date growth. The perennially popular Swift occupies its common spot at the top of the Suzuki model pile, though its 16 per cent growth pales in comparison to the Ignis baby SUV (up 421 per cent) and Jimny baby off-roader (up 126 per cent). The S-Cross and Vitara SUVs blot the copybook slightly – down 15 and five per cent, respectively.

Toyota: Up 22 per cent – small winner

Best-selling model: HiLux ute (28,076 sales; up 26 per cent)

Fastest-growing model: LandCruiser 200 SUV (11,621 sales; up 69 per cent)

The Big T is once again on course to smash through the 200,000-units barrier in a calendar year, with 22 per cent year-to-date growth adding more than 20,000 vehicles to the sales achieved this time last year.

Although the HiLux remains a sales behemoth and looks set to continue as the country’s most popular vehicle, its year-to-date growth is eclipsed by several models – notably the outgoing LandCruiser 200 Series is up 69 per cent thanks to demand for the last ever V8 diesel models before the new twin-turbo V6 diesel 300 Series arrives later this year.

The HiAce van is up 52 per cent, the HiLux-based Fortuner SUV is up 44 per cent, the Supra sports car is up 40 per cent, and the RAV4 mid-sized SUV has increased sales by 31 per cent. Other models are less fortunate. Higher pricing has hurt the latest-generation Yaris city car, which is down six per cent, the Prius hybrid continues to lose buyers (down 38 per cent to just 34 units), and the Kluger seven-seater SUV has fallen by 46 per cent (though a new-generation version was only released in June and should improve sales).

Volkswagen: Up seven per cent – small winner

Best-selling model: Amarok ute (3924 sales; up 11 per cent)

Fastest-growing (volume) model: T-Cross compact SUV (3563 sales; up 389 per cent)

VW’s year-to-date sales have been hurt by stock shortages caused by the German brand transitioning from the outgoing Mk7.5 Golf to the Covid-delayed Mk8. The 585 units shifted in the first half of 2021 is about 10 per cent of the Golfs sold in the same six-month period last year (5901 units). Take Golf (and its Alltrack variant) out of the equation for 2021 and 2020 and the picture shifts dramatically – sales would be up 51 per cent, or by 6828 units.

This is due to significant growth for VW’s SUVs and T6.1 commercial/people-mover range. The T-Cross small SUV is up a massive 389 per cent, making it the fastest-growing volume model (the Caravelle is up 783 per cent but based on just 53 units). It could replace the Amarok ute (up only 11 per cent) as VW’s best-selling model before the year is out.

The still-fresh, Golf-based T-Roc is going strongly (2342 units), and the Touareg large SUV is up 45 per cent (with V8 variants sold out and prompting a call for the hybrid R model as a new flagship). While the Tiguan Allspace is up 53 per cent, the evidence is clear that the longer, seven-seater SUV has stolen sales from the regular, five-seater Tiguan that is down 54 per cent. The Transporter van is up 129 per cent and the related Multivan multi-seater is up 202 per cent.

Volvo: Up 61 per cent – big winner

Best-selling model: XC40 compact SUV (2346 sales; up 63 per cent)

Fastest-growing model: XC90 large SUV (836 sales; up 92 per cent)

Swedish brand Volvo is on an impressive sales run worldwide – and locally it is set to pass 10,000 sales for the first time. With a four-figure sales result in June, Volvo is now at 5439 units for 2021 at halfway. To put this into perspective, Volvo Car Australia hasn’t previously sold more than 8000 vehicles in a year.

The XC40 compact SUV has been a huge success since its 2018 debut and is the leading Volvo with 2346 sales. There’s some extra growth for the company’s larger SUVs, with the mid-sized XC60 up 70 per cent to 2167 units and the seven-seater XC90 up 92 per cent to 836 units. Volvo passenger cars aren’t as successful. Sales of the S60 sedan have dropped 17 per cent and the related V60 wagon is down 84 per cent, though the latter is due to be replaced by the high-riding V60 Cross Country variant.

We recommend

-

News

News2021 VFACTS half-term sales report – Part one: Alfa Romeo to LDV

Which manufacturers are rolling with the pandemic and parts-shortage punches of 2021 as the market continues its recovery?

-

News

NewsVFACTS JUNE 2021: New-car sales stumble as utes dominate podium

Sales stall for the first time this year

-

News

NewsVFACTS: Winners and losers in May

Italian supercars tumble as Kia, Toyota and Isuzu notch up some big wins...